1999, the sequel

Sequels are always bigger

Three months into starting my own investment business, I was down 20%. I was living above my parent’s garage and had one client, a friend who had successfully sold his business after college. I was worried and confused. My dad left job postings he clipped out of the newspaper on my desk and let me tell you that did not help.

It was September of 1998 and I was wondering what was wrong with my small cap stocks.

What I didn’t know or fully appreciate is that a highly levered hedge fund called Long Term Capital Management was blowing up in spectacular fashion. Liquidity plunged and investors got scared. I was busy investing in small cap companies and they plunged on the lack of liquidity. In response, the Fed gathered all of the major banks together who agreed to manage the crisis and the Fed unleashed a spectacular amount of liquidity into the market. By the end of the year, I was up for the year and the market went parabolic.

Helping matters was the entry of the Internet into the investing consciousness. The Internet was going to change the world and there was untold opportunity. Riding a sea of liquidity, tech stocks and the broader market went through the roof. Sound familiar?

I think we are experiencing the sequel to 1999 right now. We have had a crisis (coronavirus) and worldwide fiscal and monetary stimulus the likes of which have never been seen, and now we are seeing valuations and stocks explode higher. And the signs of a speculative frenzy are all there:

1. Surge in Retail Investor Activity (i.e. Robinhood)

2. Story stocks with little earnings inexplicably surging every day (Tesla, Lemonade)

3. People poking fun at Warren Buffett and asking if he has lost his way

4. Bulls making fun of short sellers

5. Claims that new business models deserve outlandish multiples (i.e. Cloud & SaaS)

I could go on and on with pages of examples (including anecdotal evidence of people suddenly asking me how to set up Robinhood accounts or invest, who have no background and who were told by friends they need to invest to make money).

As a contrarian, I have always loved undiscovered, misunderstood or unloved companies. And this why I focus on turnarounds, spinoffs, restructurings or companies no one follows.

In 1999, my research led me to invest in a small spinoff called SonoSite which traded below its cash value and Lone Star Steel, which made oil tubular products and traded below book value. All of this looked silly in 1999, but to me the valuations I was investing in protected me from risk and allowed me phenomenal upside if something went right.

And when the market broke in March of 2000, everything started going right for my unloved small caps. And eventually, I thought I was a golden god (only to learn otherwise in 2003 and run into personal and professional disappointment, but that’s another story).

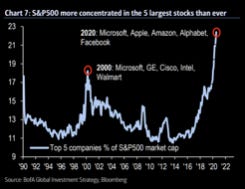

Here is why I am writing all of this. In 1999, there was an incredible concentration in the biggest names and also there emerged an enormous disparity in valuations just like there is now. But as you can see below, we have now exceeded those extremes.

Credit for graphs: (@marketear and O’Shaughnessey Asset Management)

And I think this sets up an incredible risk/reward opportunity to invest in small companies at low valuations. So many investors are so focused on calling the direction of the market, they are missing out on where the real values in the market are right now.

I have been hunkered down doing due diligence and focusing on where the value is: small cap companies. And I believe the next couple of years will offer similar returns to 2000-2002.

I’m finding companies that inexplicably sell below book value like Nelnet (NYSE: NNI). You can read my report here: Nelnet: The Quiet Technology Compounder

And there are also stocks that sell at 10 times trough earnings with great business models and counter-cyclical plays that potentially sell at 1.5 times cash flow 12-24 months out (I plan to write about these in the future).

In 1999, I looked silly despite having a good year. It felt like I was missing out on the mania. But, when the market collapsed, there was no better place to be. My feeling of déjà vu is very strong right now and remember that the sequel is always bigger and grosses more money than the original.

P.S. for those saying that this time is different because companies have better business models, I have two counters. First, there was no better business model ever than Microsoft. In 1999/2000, the company possessed a monopolistic position while popping off 40% operating margins. Second, many people mistake the 1999/2000 bubble as one that was primarily focused on Internet stocks, but they were a tiny fraction of the real bubble in tech and telecom stocks. They were profitable and showing fantastic growth.

Last note, I could very well be wrong, and I am, sometimes wrong, but at these values, I can afford to be wrong quite a bit and should still win.

Here is some further reading on the opportunity in small cap value to read as well:

Good read, thank you for writing. Counter to your counter - Microsoft was extremely dominant, but the PC market was close to saturated, and then they largely missed on mobile and search. Amazon today on other hand is extremely dominant, but ecommerce and cloud still have huge runways. Not saying that Amazon is indicative of the entire market. These are just two stocks we're discussing.

Love the 3rd point in a market frenzy being people poking fun at Buffett saying he lost his touch