An Update on The Most Undervalued Stock in North America

Why Consorcio Ara Is an Even Better Investment Today

A year ago, I wrote about Consorcio Ara (Mexico: ARA), a leading Mexican homebuilder, that remarkably sells for less than 40% of book value, generates a double digit free cash flow yield despite and has excess cash leaving it effectively debt free and is sitting on a massive land bank. Finally, ARA probably trades at 25% or less of its real net asset value, as the book value is not up to date to today’s market value.

The stock has gone nowhere since I wrote it up. I’ve clipped a 4% dividend, and now the dividend is increasing as well (they are poised to pay over a 5% dividend this summer). There hasn’t been any amazing news besides solid execution, increasing profits, dividends, margins and returns, but I’m here to tell you that things are even better now than when I wrote it up a year ago.

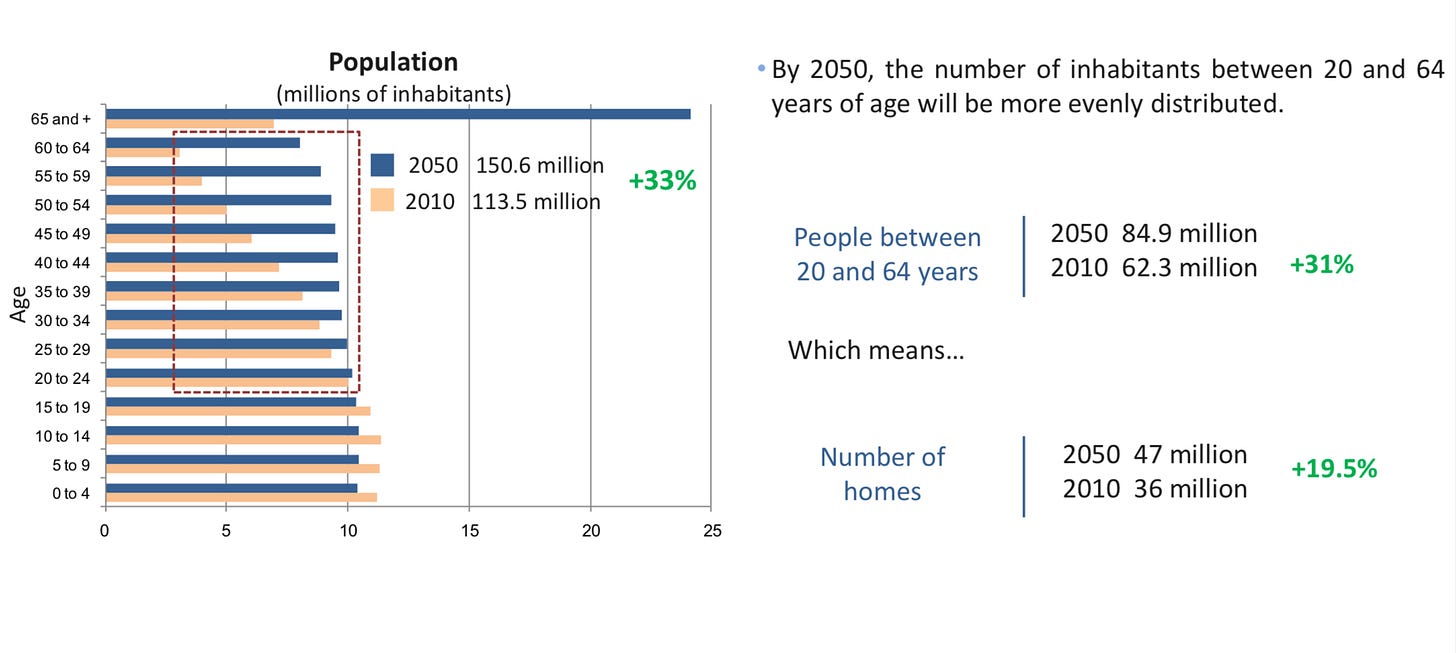

Why? First, there is a demographic boom about to hit Mexico. The average age in Mexico is 29. In the U.S. peak home buying occurs around the age of 29 as that is when people start having kids and often want and need extra space. In Mexico, due to lower per capita wages, the peak home buying probably occurs around 33-35, meaning that the country has yet to hit peak housing demand.

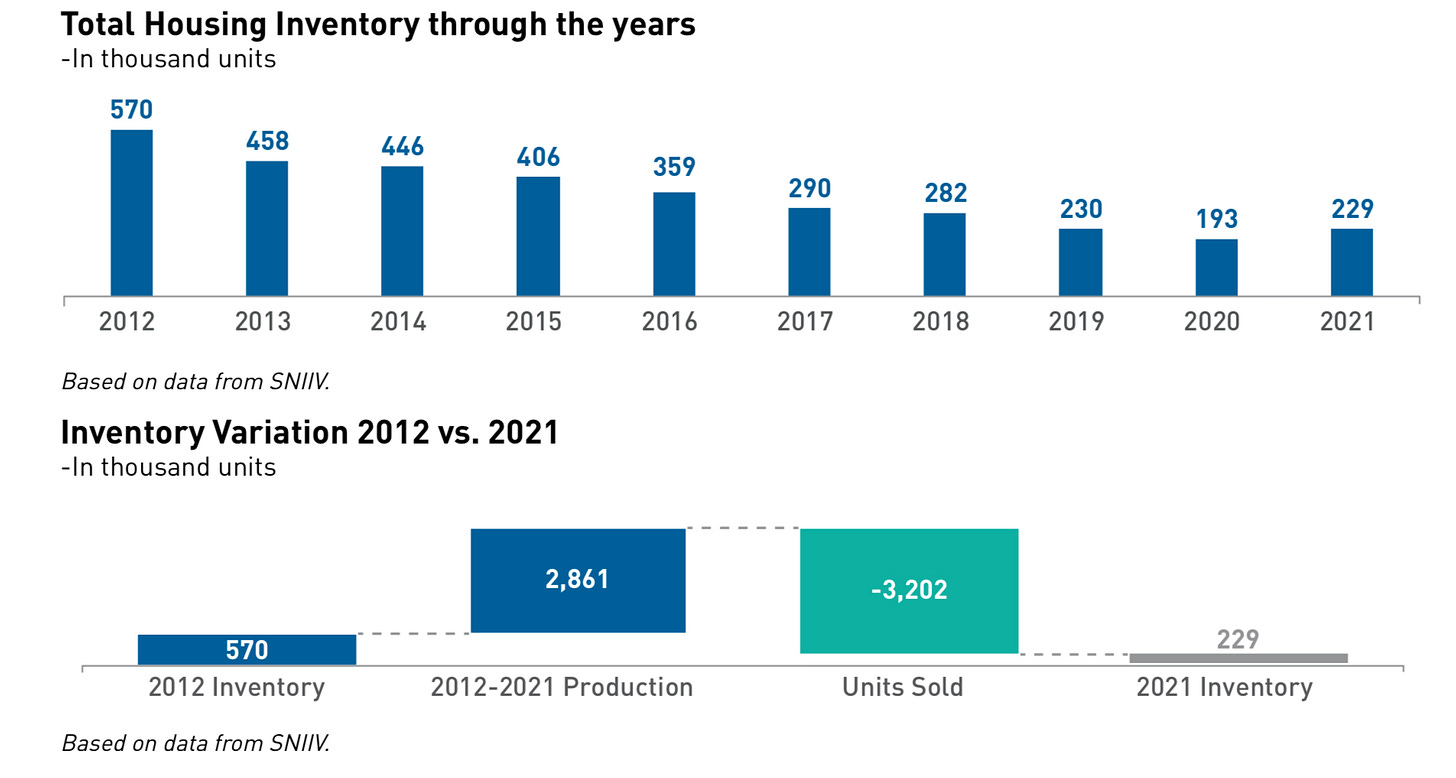

Combine this coming surge in demand with already super low inventory of housing and you potentially have a perfect storm like what we have seen play out in U.S. in the last five years.

But the bigger update from last year is the clear signs of retrenchment of the last 30 years of globalization and what it means for Mexico and ARA. It makes zero strategic sense anymore for companies to have supply chains so far flung from home especially in a time when we have tension with China and now war in Europe. There is a very clear expectation that more manufacturing will have to come back to the U.S. or much closer to home. And the only country that makes sense to me that could help in this retrenchment is Mexico.

I’m not the only one coming to this conclusion, other investors are starting to ponder how Mexico might benefit as well including well respected money manager Dan McMurtie with Tyro Partners:

With more manufacturing and more re-shoring close to home, comes jobs and with jobs comes income and with income comes demand for housing. All this hits at the same time as a demographic wave causes housing demand to surge with little inventory to cushion the demand wave.

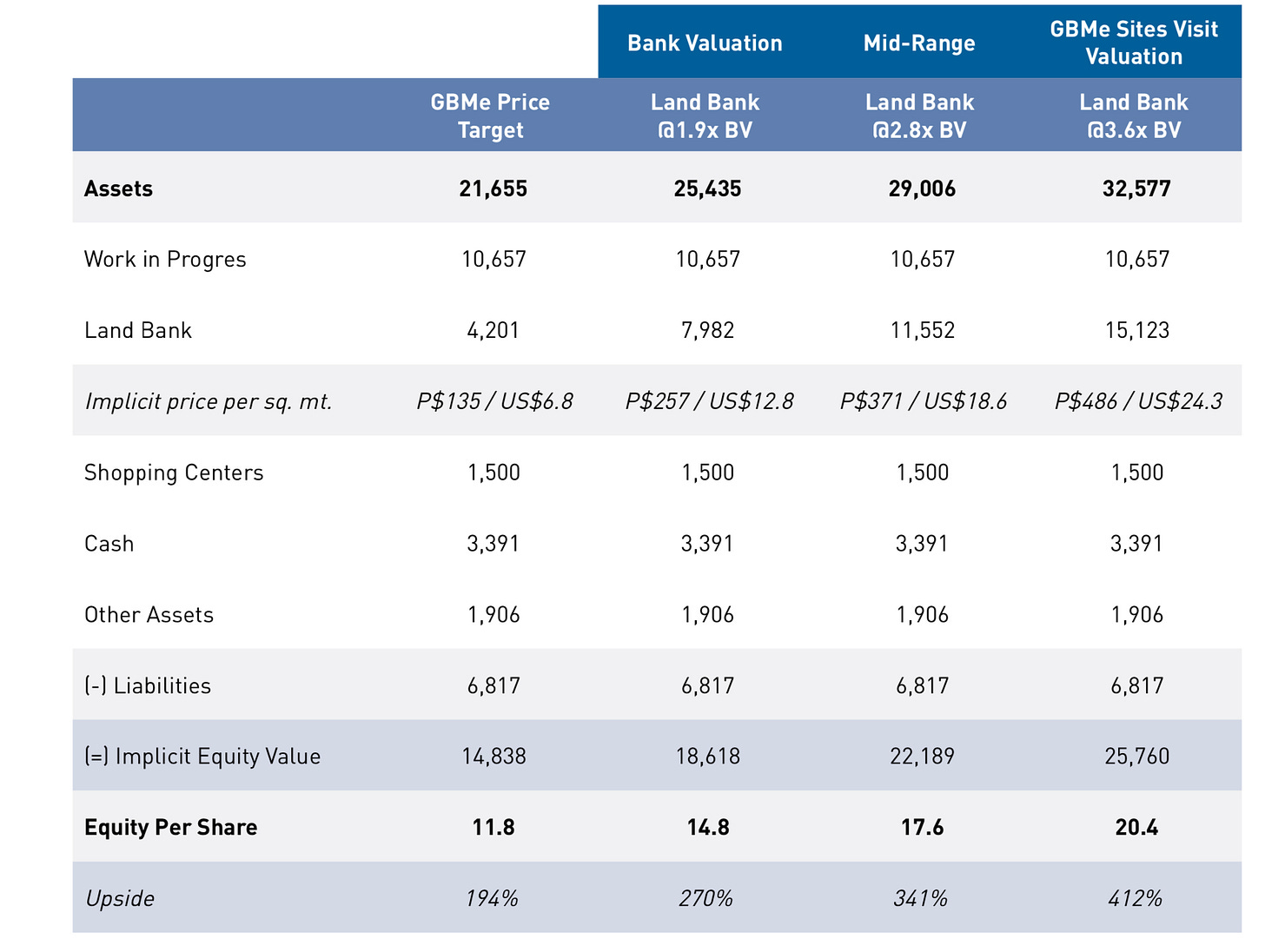

Combine that with a super boring, ignored stock that trades at less than 40% of book value and it is my belief that returns could be spectacular. In my opinion, Ara’s true market value is at least 15 pesos per share. I estimate that net asset value for the company (ARA’s assets include two different destination properties of more than 1 kilometer of beachfront each) could easily top 30 pesos per share in five years if this value grows by 15% a year. Compare that to its current price of around 4 pesos per share. A recent GBM (leading Mexican brokerage) report shared this analysis of ARA:

And while we wait for the demographic wave to hit and jobs and factories to get relocated to Mexico, you get to sit back in an inflation protected investment and clip a 5% dividend. In these uncertain inflationary times, I’m more than happy to wait for what is coming with paciencia y fe.