Betting on the Tortoise

The Benefit of Owning Boring Stocks in a Volatile Time

"Someone will always be getting richer faster than you. This is not a tragedy." Charlie Munger

Not too long ago, it seemed everyone wanted to talk or tweet about Penn National Gaming (NASDAQ: PENN) and DraftKings (NASDAQ: DKNG). These stocks were sure fire winners in the bright new future of sports gambling and had soared in price. These stocks were trading on hype, near constant press and a barrage of tweets. If you were lucky or you are a great trader, you sold out of these names and clipped a great short-term profit.

If you didn’t sell, you might still be up on PENN, but you are now flat or down on DKNG. And while I’m not a technical analyst or chartist, their stock charts don’t look so pretty right now. Further, I don’t see many tweets these days about PENN or DKNG. This is a nice reminder that stock prices often drive narratives.

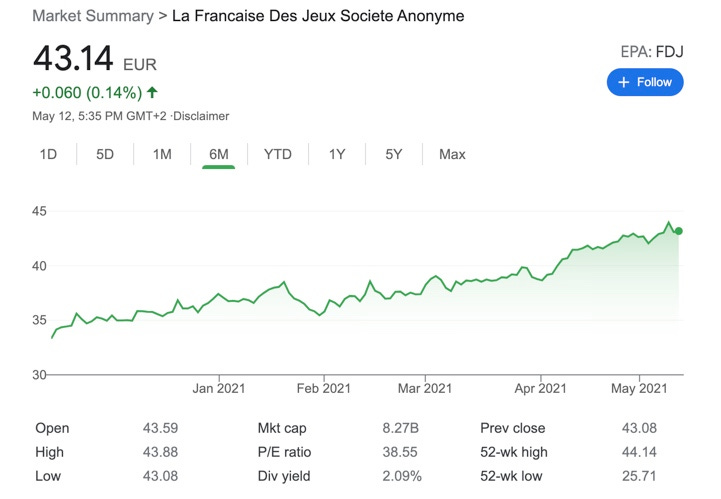

While those stocks were beginning their epic run last November, I wrote about La Francaise des Jeux (France: FDJ), a French gambling company no one was talking about, in a country not known for great stock investments.

Like a plodding tortoise, FDJ did not sprint out to the front of the pack. It has slowly and surely gone up a little bit at a time on the back of an impressive year end and first quarter earnings. Most importantly, the company is becoming more profitable on the back of greater online lottery participation, which has twice the margins as retail.

The company has net cash on their balance sheet despite having one of the most resilient business models around, is as boring as you can imagine, but is exciting to me because unlike PENN or DKNG, FDJ is gushing cash. The company converts an amazing 80%+ of its EBITDA into free cash flow. Free cash flow excites this wizened value investor, especially as this cash flow stream is coming from an actual monopoly.

The story may not be as exciting as PENN or DKNG, but that’s A-ok with me, because while PENN and DKNG duke it out in the ultra competitive landscape of American sports gambling, FDJ prints cash from a monopolistic position. I find monopolies to be boring and quite beautiful.

Let me share another boring name that rarely pops on Twitter, but which I have written about before: Nelnet (NYSE: NNI). The company announced strong Q1 earnings, and the response from the markets was deafening silence. And that reaction is also perfectly fine with me. I’m not investing in NNI betting on jumps in the stock price after they report earnings, but for the long-term value they are building. They have been growing book value at over 17% a year for over 15 years, with no slowdown in sight.

And while no one was paying attention (Nelnet doesn’t hold quarterly earnings conference calls), NNI’s Q1 results were really good, with $3.20 in eps for the quarter. It is remarkable that this stock trades around book value and less than 10x earnings, as it generates tons of cash.

Nelnet is the quiet technology compounder that screens like a student loan company, while it continues to grow and invest in technology. I know of no other technology company that trades near book value.

One example as to why Nelnet may actually be exciting and not the boring student loan company it appears is its investment in HUDL. The youth sports company is about to do another capital raise that will probably make it a tech unicorn (over $1 billion valuation), and I expect this new valuation will drive NNI’s book value to around $73.50 per share. NNI not only continues to be undervalued, but totally misunderstood.

If neither FDJ nor NNI go anywhere in the short run, that’s fine. I am confident that both businesses will continue to grow their value and think the current share prices do not reflect either the underlying quality of the business nor the growth potential as well.

Fear of missing out and envy will drive you crazy. There will always be stocks and investments that are making eye-popping returns. I’m of the opinion that there is alpha in arbitraging everyone’s short term focus and simply making low risk bets on opportunities that have long runways ahead of them.

When I was younger, I loved following hot stocks of the moment like PENN and DKNG. But now as I get older, I find comfort in the boring tortoise companies, knowing full well that they are the ones that often end up lapping the tired hares in the end.