As incredible as this may sound, California begins the new year short of something that has been in massive oversupply for almost two years: cannabis flower. You may be thinking “what is Aaron smoking,” but cultivators both large and small based in Northern and Southern California are now telling me the same thing: prices are rising for cannabis flower after 18+ months of declining. And they are rising at a time of the year when they shouldn’t be increasing.

Further confirmation of this price trend came from Glass House Farms (OTC: GLASF) when they announced preliminary Q4 numbers and reported that their average sales price was $234 a pound, up from $204 a pound. But this “average” downplays the size of the price bounce because prices started the quarter at around $200 a pound. For prices to end the quarter at $234 implies that prices were closer to $260-$270 a pound by quarter’s end. That’s a 30% bounce in three months and this is consistent with what private growers tell me they are seeing.

Why this is remarkable is that prices should be the seasonally weakest right now. Every year, outdoor crops get harvested during the September/October period in a time known affectionately as “Croptober.” Also, with extra sunlight and longer days, the state’s greenhouses have their best production as well. All of that product then hits the market and pressures prices lower from November to sometimes as late as February, at which point there is seasonal strengthening into the summer and the process repeats itself.

That prices are rising now should be setting off alarm bells that something special is happening. I have previously written that California cannabis was going through its “negative crude oil price moment” and that prices had fallen way below the marginal cost of production for most farmers.

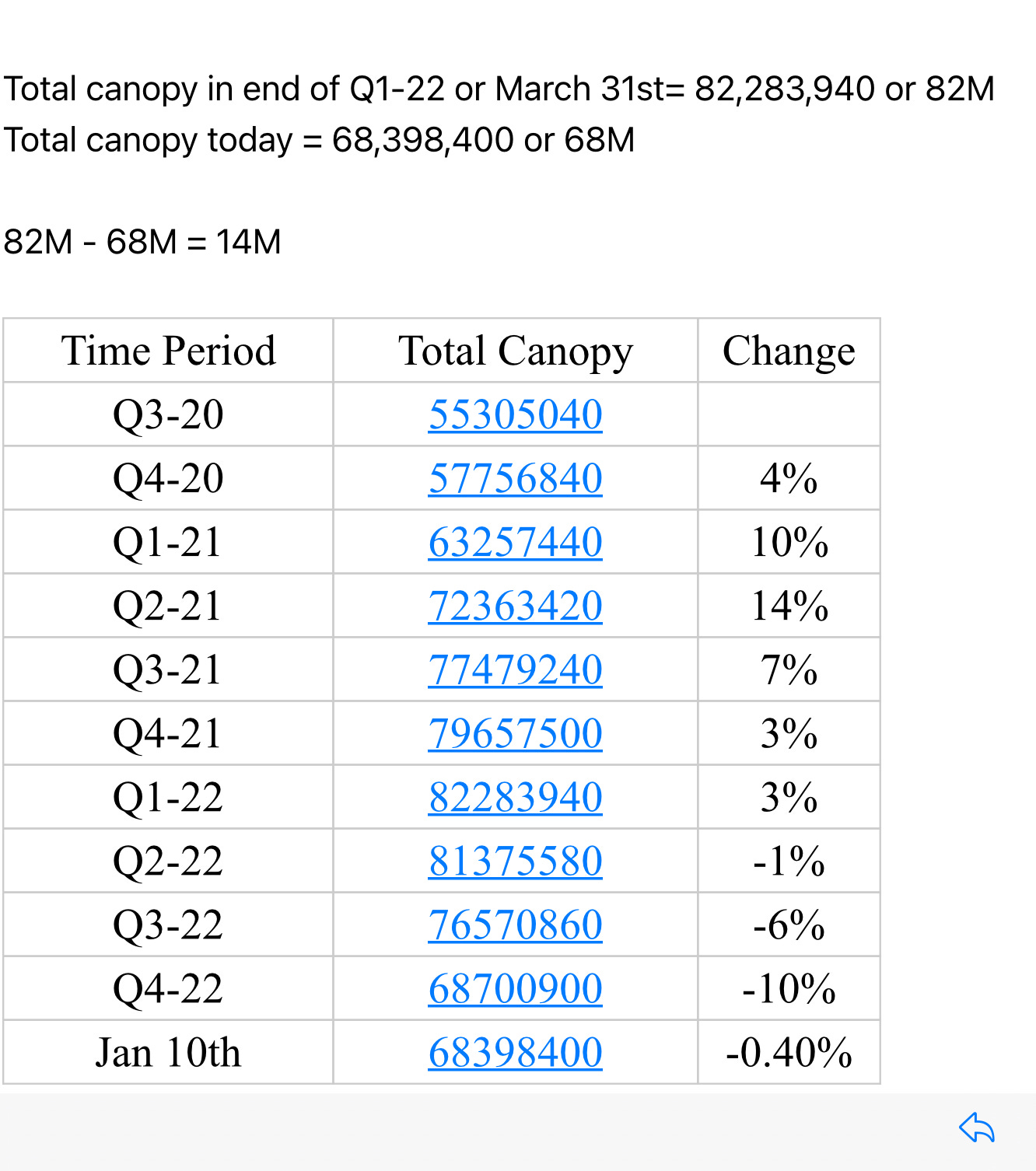

With no capital available due to tight conditions in the cannabis industry, there is no room to fund losses for very long, so farms are going out of business and shutting down operations. You can see this playing out in real time with cannabis license renewal data from the state of California.

Since March 31, 2022, a whopping 14 million square feet of cultivation canopy has abandoned their licenses and not renewed. Just in the last ten days, 400,000 square feet has left the market.

What is remarkable is that the bounce in prices is still not enough for most producers. One Northern California producer that I heard from still plans to cut cultivation in half and lay people off, because the pricing is just approaching his breakeven. In other words, supply is still being taken out of the market. (Note that farmers planting less but keeping their licenses is not reflected in the license non-renewals, that means that production is falling even faster). I expect even more farms to not renew and more farmers to walk away. Based upon my conversations, I estimate that California cannabis pricing needs to rebound at least another 50% to get back to where more farms can make money.

Further exacerbating the supply crunch is that last year many outdoor producers froze their flower called “flash frozen” flower which is then sold as an input to distillates, vapes, edibles and other consumables. This means even less fresh flower is available in inventory than normal.

And this is leading to very low levels of inventory. From one of my best sources, I heard that Humboldt County, one of the largest outdoor producing regions of California, has sold through 70% of their inventory and is now asking for $50-$100 price increases where two weeks ago there was no change in pricing.

Finally, all those farms that have gone offline and have not renewed are not coming back online any time soon. That is because California changed its rules last year and now license holders must be fully compliant with one of the most brutal state laws in the country: CEQA (California Environmental Quality Act). It used to be that there was a lot of leeway and time allowed to comply with this cumbersome, complicated, expensive regulation. Now license holders must be compliant on day 1.

So, while technically, these farms could feed the illicit market and/or send their product illegally to other states, none of this supply will come back anytime soon into California’s legal market.

And all of this bodes really well for Glass House, which owns the largest cannabis greenhouse in the world, that competitors have called the “Ferrari of Greenhouses.” Many consider Glass House only a bet on interstate commerce and discount the upside potential of just California, which despite its problems is still the largest cannabis market in the world.

Consider that Glass House is on track to produce 300,000 pounds of cannabis biomass this year. Every $100 a pound increase in biomass pricing increases cash flow by $30 million with no corresponding increase in cost.

But even though pricing is rebounding, there is still broad distress in California. I’m hearing that 40-50% of retailers are in distress and struggling to pay their bills. A very high-profile example is Statehouse (OTC: STHZF), which was just sued by a vendor for not paying them.

And this is probably why, despite Glass House reporting higher prices in Q4, the company did not see their overall gross margins rise in the quarter. Their CPG business continues to struggle, probably because the retail environment is not conducive to expensive branded products right now. The company has moved to grow its value brand “Alls Well” to attack this very problem, but it may be a while before we see a recovery in this division of the company.

And aside from the retail distress, the recent historically bad weather that just hit and continues to affect California is going to hit cannabis cultivators as well. For many small farmers, there will be additional unplanned capex at a time when money is short. And normally production is already seasonally lower due to shorter days and rain, but this December/January has been rainier and cloudier than usual compounding the supply woes.

Glass House’s President Graham Farrar even mentioned this in a recent article: “Aside from the immediate impacts of the rain and wind, Farrar pointed out that cloudy weather the past several weeks has been the lowest light levels he can remember in years.”

While Glass House could see a somewhat smaller harvest in Q1 due to less sunlight, this weather should pressure the overall supply side of the equation even more. Consider that the next big production won’t be available until October/November or the next Croptober harvest. And private operators are telling me not to expect another major Croptober this year or into the future unless prices rise substantially from here.

The most fascinating part of this is that a few smart operators in California are starting to shift their thinking from survival to wondering when to press forward with expansion. And very few are capable of such an expansion. Now the question is how high do prices rise. Anyone who studies commodity markets knows that it is the marginal supply that drives prices. In bear markets prices can fall much farther than you think, but in bull markets, they can also soar much higher than one can imagine.

Regardless of whether supply moves up or down, I know one thing. People haven’t stopped smoking cannabis in California.