De-Banked!

Chase Gives Me the Boot Because of Cannabis Investing

A week ago, President Trump posted a video praising the endocannabinoid system and highlighting the potential benefits of cannabis legalization. It was a surprising reminder that the President appears to support cannabis reform—and his post re-energized publicly traded cannabis stocks desperate for any hint of progress for cannabis reform.

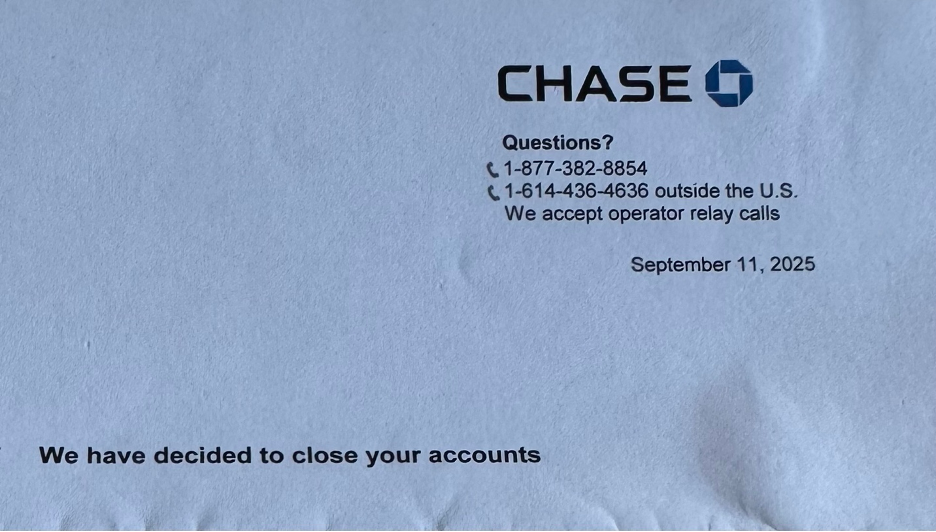

So, imagine my surprise when I opened what I thought was a piece of spam mail from Chase Bank—only to discover they were closing my personal checking account, debit card, credit card, and even my children’s savings accounts. The reason? Because I invest in cannabis companies for a living.

Chase had already shut down my investment fund bank accounts last year. At the time, I assumed they simply didn’t want exposure to the actual cannabis-related transactions. But apparently, even my daughter’s savings account is now too risky for a $4 trillion financial institution.

This whole episode is yet another reminder of how disconnected the cannabis industry is from mainstream finance. The largest bank in the United States is still de-banking both businesses and individuals connected to the cannabis sector—in 2025—despite 40 states having legalized medical cannabis, and 24 allowing full adult use and hemp being federally legal.

Cannabis investors often dream of stock-exchange listings, but basic financial services like bank accounts and credit cards are just as essential to a functioning industry. And on that front, the cannabis sector is still a mess.

When major banks like Chase eventually reverse these absurd de-banking policies, the cannabis industry should enjoy a massive tailwind. Despite being starved for capital, the industry continues to grow because consumer adoption keeps expanding.

One day, financial institutions may be begging for a piece of the cannabis business. Chase would be wise to get ahead of that curve.

P.S. Honestly, this might turn out to be a blessing in disguise—God knows how many forgotten subscriptions I’ll finally get to cancel!