Declining Alcohol Consumption

One Market’s Story as Part of a Bigger Trend

This is a picture of a vineyard in Australia burning vines because there isn’t enough demand.

I’m a small investor in a neighborhood market in Atlanta. It’s been a phenomenal investment over the past 15 plus years, as I have received my initial investment back multiple times, and my stake is still worth a lot more than my initial investment. The key to this investment was its location. The convenience of a neighborhood store in an upcoming part of Atlanta was undeniable, and the store made it easy to pick up food and drinks, and especially alcohol without having to brave Atlanta traffic. The selection of wine and beer is hard to beat at our store and it has paid off handsomely for investors.

This past Sunday was our annual performance review meeting for 2023 and it contained a big surprise. Sales for the first time in our 15 plus years of investment went down (except for COVID disruptions). I haven’t been keeping close tabs on this investment and I was surprised, but I shouldn’t have been.

Diving into the details, food sales were up, deli sales were up, coffee sales were up, and non-alcoholic drinks were up. But alcohol sales were down. This hurt overall sales, because wine, beer and spirits are a big percentage of sales, but it really hurt profits as alcohol beverages have much higher margins than the other categories. Overall sales fell 7%, but profits fell by 15%.

None of this should be a surprise to me as I have been researching from a macro perspective about how consumers are turning away from alcohol. The next generation is not as interested in drinking alcohol and my generation is looking for healthier options.

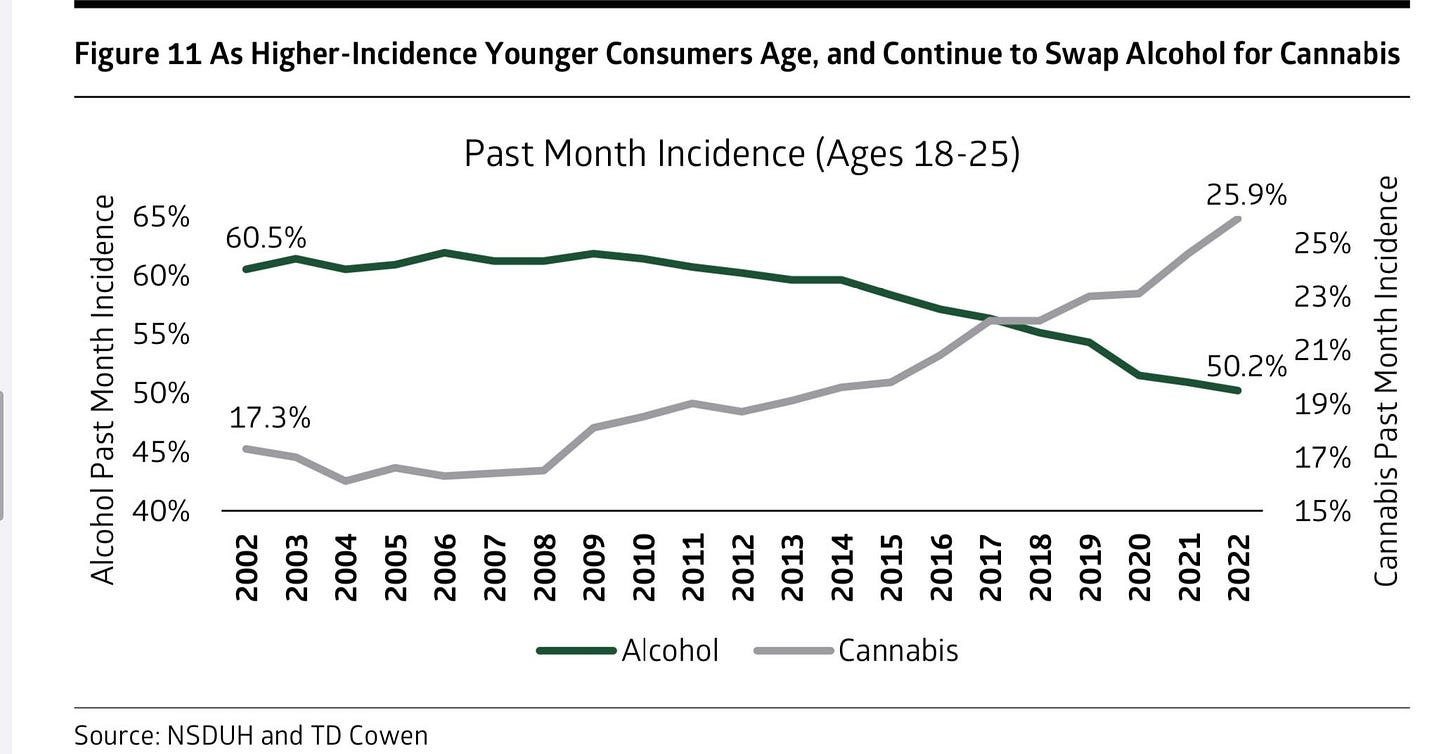

I shared this graph in a previous post about cannabis being the great replacement, especially for alcohol.

Evidence of slowing or falling alcohol sales are also showing up in earnings reports of major publicly traded alcohol companies. Spirits producer, Brown Forman (NYSE: BF.b), and wine producer, The Duckhorn Portfolio (NYSE: NAPA), announced flat sales for last year and lowered guidance on a “weak demand environment.”

For a more dramatic example of how declining alcohol consumption is affecting the alcohol industry, see this article about wine producers:

Across California, farmers are ripping out their vineyards en masse. This uprooting is the result of a yearslong oversupply: With wine consumption in the U.S. declining, wineries are decreasing production, which means they need fewer grapes.

So, what is the consumer who no longer wants to wake up groggy or with a hangover and no longer wants the negative long-term effects of alcohol turning to? Non-alcoholic sales are soaring. The Wall Street Journal recently had a long article on non-alcoholic beer company, Athletic Brewing Company.

But what about if you want a drink that actually causes an effect? What can you drink that isn’t alcohol but gives you a bit of a buzz?

Enter low dose hemp THC beverages. Imagine a drink that relaxes you, gives you a slight buzz, food is more pleasurable, music is more enjoyable, your sex drive increases, you sleep great at night and most importantly you wake up the next morning with no hangover. Sounds like a miracle drink.

And this is why consumers are going nuts for them. This whole trend started when Minnesota legalized cannabis and legislated rules that low dose hemp beverages could be sold anywhere. And now what has started in Minnesota, has not stayed in Minnesota. Consider that Total Wine, one of the largest alcohol retailers in the country, is now selling hemp drinks in Minnesota, Connecticut, Tennessee, Texas and soon will offer them in California.

Why is Total Wine moving so quickly? Because liquor stores and alcohol distributors are calling these drinks the “golden cases.” Not only are the sales velocity really high, but margins are higher than even alcohol. Maybe this is why the Wine Spirits Wholesale Association (WSWA) is lobbying on behalf of cannabis legalization now.

I think hemp beverages are an alcohol replacement for people looking for something other than traditional booze and I think these beverages are going to capture at least 20% market share of the US alcohol market and the category is going to generate at least a $50 billion annual sales one day.

This is why I just closed a hemp beverage venture fund and why I have already made five investments and I’m on the hunt for more beverage investments that fit my criteria.

And guess what market in Atlanta is carrying one hemp beverage and is now talking to all of my hemp beverage companies about carrying more brands in their store? That’s right, the market I’m an investor in.

Hemp beverages are the future and retailers and distributors are going to follow wherever their customer tastes and demands lead them to. The future is low dose hemp drinks and the whole alcohol industry is turning its attention and resources to what is flying off the shelves.