The cannabis sector is in a major bear market since the highs in February when optimism of a Democratic takeover of the Senate sent cannabis stocks to all-time highs. Since then, it has been all downhill with many companies declining 50% or more. A combination of restricted capital flows, poor liquidity, and diminished hopes for any major legislative change has led to investors moving on to greener pastures.

Even companies that don’t touch the plant itself and are allowed to trade on the NASDAQ like GrowGeneration (NASDAQ: GRWG) are down 50% from their highs. But these declines hide stunning price performance. For example, GrowGeneration is still up an astounding 1,300% in the last five years. Why has GrowGeneration been such a phenomenal investment? It definitely helps that the stock is able to trade on the NASDAQ since it doesn’t directly touch the plant, but instead sells the picks and shovels of growing cannabis. And since the cannabis market and the market for anything that helps grow cannabis plants has been on fire, so have GrowGeneration’s sales and profits.

GrowGeneration’s first outside investor was Mitch Baruchowitz and Merida Capital. I interviewed Mitch in March and I think Mitch and his team are some of the smartest and most original thinkers in the cannabis space. His firm’s investment record is incredible, even while the numbers have come down recently with the pullback in the cannabis space.

I watch everything that Mitch and his team invest in for that reason. And so, I was quite excited to see that Merida’s SPAC (Special Purpose Acquisition Corporation), Merida Merger Corp (NASDAQ: MCMJ) announced an agreement to merge with Leafly, a cannabis marketplace company.

What was even more fascinating is that due to the overall weakness in the cannabis space and an implosion of several high-profile SPACs, the market reaction was to ignore the whole announcement.

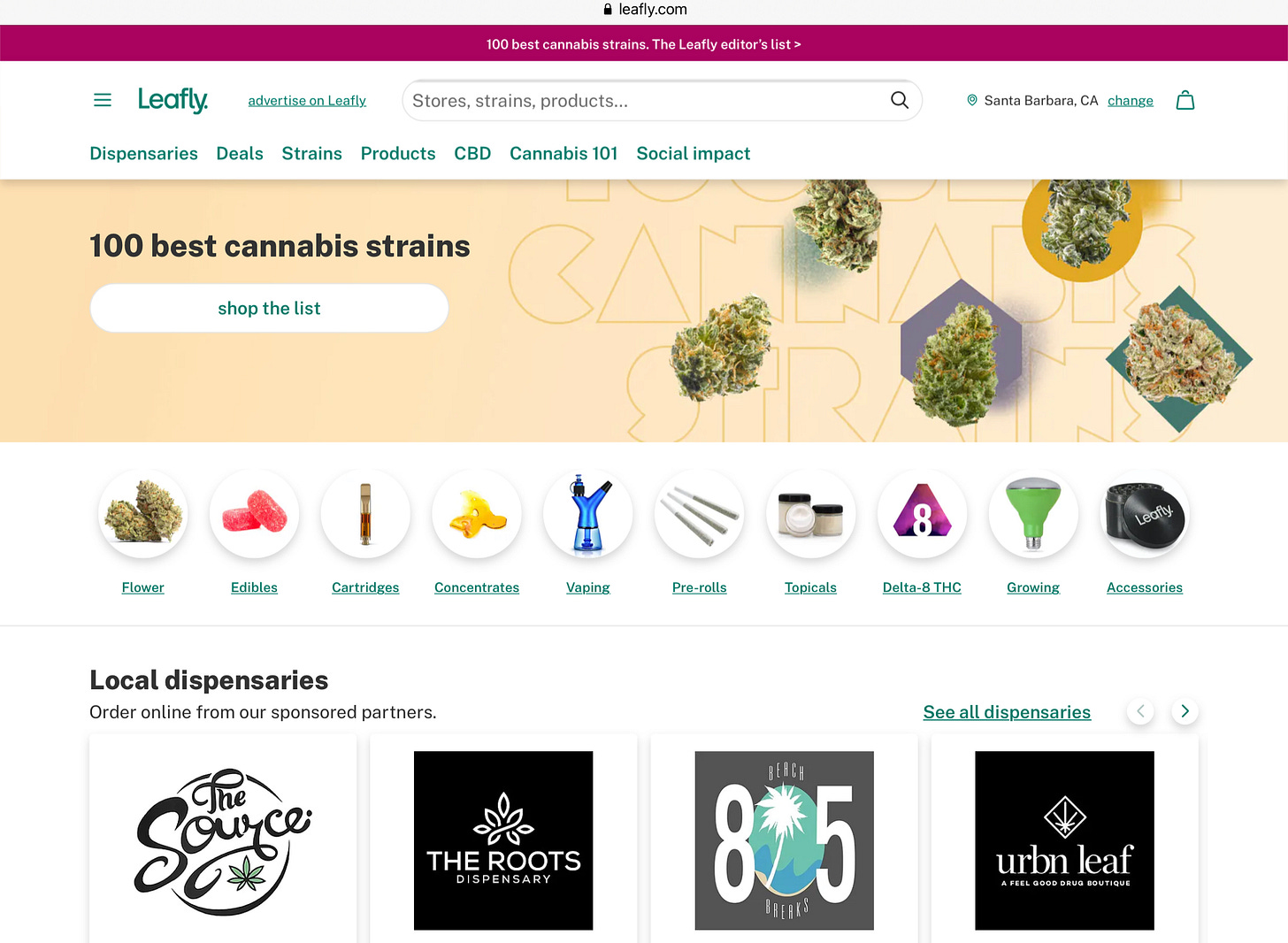

But investors should pay attention to the many similarities to GrowGeneration. Leafly is one of the leading websites and apps to learn about cannabis, find dispensaries that sell cannabis and order it online. Leafly doesn’t touch the plant and instead facilitates finding and ordering what you want. Customers then pick up and pay for the products at their local dispensary.

And since Leafly doesn’t touch the plant, it will be allowed to trade on the NASDAQ. There aren’t many ways to invest in the future growth of cannabis that doesn’t involve touching the plant and I can’t emphasize how big of a deal this is.

And just like GrowGeneration, Leafly is helping arm the growth of the cannabis industry, but instead of physical supplies like soil and lights, it sells digital tools for dispensaries to advertise and market to consumers who want to research and buy cannabis.

And it’s not just dispensaries that want to be part of the Leafly marketplace but also emerging brands, who want to advertise. There is a serious problem in how to advertise or reach customers. A recent article highlighted the situation where Instagram has been taking down cannabis accounts left and right. So, where are brands supposed to advertise? Their options are limited.

Last year, over $400 million of cannabis was ordered through Leafly’s marketplace. In some states like Arizona, where Leafly has 90% market share, there are “Leafly windows,” where dispensaries have dedicated staff to fulfilling Leafly orders. Leafly has a remarkable 10 million monthly active users.

The return for dispensaries is quite phenomenal. Consider that dispensaries paid $34 million to get that $420 million of sales, or a 12 to 1 return on investment. Where I come from $12 of sales for every $1 paid is money well spent.

Leafly has an incredible opportunity to grow its top of funnel dominance of 10 million active monthly users as giant east coast markets like New York, New Jersey and other states open up for business. And right now, it is clear from Leafly’s take rate of only 7% that the company is under-monetizing its customer base.

Remarkably, Leafly currently only employs 20 salespeople in the entire company. This is both part of the promise and problem with Leafly. The last two years have been tumultuous with a revolving door for the CEO position and a 50% reduction in head count during Covid. What is remarkable is that Leafly grew 20% year over year despite a 50% reduction in head count.

With a solid new CEO hired last year and a renewed focus on cannabis ordering, combined with an infusion of capital from Merida, Leafly seems poised for growth.

And the company is already expanding. The company’s job listings section on its website has a slew of job openings already.

And this is one of the reasons for the SPAC. The company wants to invest $50 to $75 million in growing the user and dispensary base. It understands that there is a massive land grab for a potential $100 billion market in ordering cannabis.

The big behemoth in the industry is Weedmaps (NASDAQ: MAPS), which itself went public in a very successful SPAC transaction, as it currently trades 30% higher than its original $10 SPAC IPO price.

Leafly is the #2 player that has been under-resourced until now. The company completed a $32 million fundraising round right before the SPAC announcement, and Merida Capital has already committed another $10 million at $10 per share to get the deal done. That means that for the deal to be completed and enough capital to be raised for Leafly to execute on its plan, only need $17 million needs to be committed from the $130 million in the SPAC trust.

In other words, only 1.7 million shares out of 13 million shares outstanding of the original SPAC investors need to commit their capital and not redeem. That is not very many shares needed to complete the transaction. So, the odds of this transaction moving forward is quite high. And the possibility of a low float, NASDAQ listed cannabis name means that the post-SPAC Leafly could really move.

The other positive is that 50% of Merida’s sponsor shares (every SPAC sponsor gets sponsor shares that are earned upon the successful merger of the SPAC with the target company) are deferred to only kick in if Leafly’s revenue doubles or triples or the stock is 35% to 65% higher. Between committing $10 million at $10 per share and deferring half of the promote, Merida is sending a powerful signal that it believes in the future of Leafly.

As I wrote in my post about AYR Wellness (OTC: AYRWF), I think SPACs are the perfect vehicle for the cannabis space which is capital constrained due to the differences between Federal and State legality, and other assorted rules and regulations. And as Weedmaps shows, SPACs can work well, especially ones in businesses with 90% gross margins like Weedmaps and Leafly possess.

One consideration is that Merida is an investor in some interesting data and marketing companies that are private and would be wonderful tuck-in acquisitions into a larger company (like Leafly). This larger company could offer a slew of enterprise solutions to cannabis retailers and brands beyond ordering. Leafly may look like a small company now, but it is not going public to stay small.

The opportunity could be enormous. Simple math says that if they can grow the amount of cannabis ordered through Leafly’s platform from 2020’s $420 million to $1 billion in a few years and their take rate increases from 7% to 12% (Doordash’s is 15%), Leafly could be doing $120 million in revenue. Add in $30 million from brand advertising and you have a $150 million revenue business at 90% gross margins and what should easily be 30% operating margins. It would be surprising in that scenario if Leafly was worth less than $1 billion.

And this is what makes not only the stock interesting, but the warrants (NASDAQ: MCMJW) as well. The Weedmaps warrants (NASDAQ: MAPSW) went up 15 times at one point and are still up over 4 times in the last year. Merida’s warrants look especially underpriced at $1 considering how few shares have to be redeemed for the transaction to move forward.

One of the hardest things is watching great cannabis businesses struggle on secondary and tertiary Canadian stock exchanges with limited liquidity. With Leafly trading on the NASDAQ, liquidity should not be a problem. Add in a wonderful 90% gross margin business needing a little bit of capital to follow the success of Weedmaps, and Leafly’s stock and warrants offer a ton of upside and seem mis-priced to me.

But ultimately, when it comes to cannabis it pays to bet on Mitch and Merida.

For further due diligence please see the most recent Leafly presentation.

Also, if you are interested in cannabis investments be sure to follow Merida Capital on Twitter.