Invert, Always Invert

A TOKE Strategy Update

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” Charlie Munger

Munger often quoted Carl Jacobi, the German mathematician: “Invert, always invert.”

· If you want to be wise, ask: “How could I make myself stupid?”

· If you want a happy marriage, ask: “What would destroy a marriage?” and then avoid those things.

· If you want to be a good investor, ask: “What behaviors would guarantee terrible results?” (Overtrading, leverage, ignorance of costs) and then avoid them.

In cannabis investing, the question might be, what companies are in trouble? Charlie would tell us to be wary of companies like the cannabis company, Planet 13 (OTC: PLNH).

In the first six months of the year, Planet 13 burned through almost $11.4 million through losses in cash flow from operations and spending on capital expenditures.

In Q2, revenue fell over 13% and loss from operations doubled year over year to almost $7 million. And while the company still has over $15 million in cash, it drew a $9 million credit line that is due next June to help sustain the cash balance on the books. Planet 13 is not paying 280e taxes and has accumulated a $27 million “uncertain tax liability” position on their balance sheet as well during the past six months.

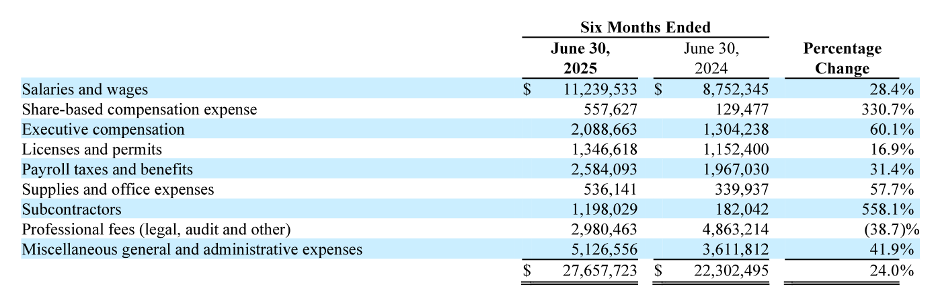

More worrying is that almost across the board, the company’s costs are rising. The following table is from the company’s Q2 financial filings:

In particular, their lease expenses are increasing due to expensive sale/leaseback terms with escalating lease payments:

This comes at a time of continued price compression in their markets, including in the key market of Florida, where 22 new operators may begin operations next year and may further pressure the market.

Not surprisingly, Planet 13’s stock has fallen 37% this year and is down 93% in the last five years.

So, why am I writing about Planet 13?

Investors in cannabis have been decimated the last five years. Most cannabis ETFs are down 80% or more. Many private cannabis funds have shut down. And in my opinion investors keep making the same mistake over and over again, praying that Federal Reform can save troubled companies and business models.

When Trump made his cannabis comments in August, we saw huge jumps in stocks like Planet 13, which saw its stock double in a few days.

Now zoom out and look at the past five years:

The problem is that Federal reform may not save Planet 13. The company is already not paying 280e taxes and its business model seems to be very much in trouble. Any speculation in Planet 13 is potentially a “greater fool theory” of investing which sometimes works in meme stocks.

This is not how Mindset Capital invests. And this is not how Cambria’s cannabis ETF, TOKE, invests either. We are the research consultant of TOKE, and you will notice that Planet 13 is not on the list of holdings. Avoiding troubled cannabis stocks is one big reason why TOKE continues to outperform other ETFs, not only over the long-term, but in the short-term as well. Please note that TOKE is the best performing cannabis ETF year to date, as well as over the last one, three and five years.

At Mindset and with TOKE, we are trying to invest based on bottoms-up fundamental research and fully admit we don’t always get everything right. We are also trying to determine who will be the long-term winners. We do not have a crystal ball on when and how Federal reform will happen and while it can be fun and exciting to speculate, we think gambling on troubled companies is the road to the poor house. There are several troubled cannabis companies, and we hope to continue to outperform by following Charlie’s advice and to invert, always invert.