Iomegans, Identity and Investing

The Downside of Getting Too Attached to Your Investments

Iomega was poised to dominate the world of technology. Specifically, it was going to take over the disk drive market. This may sound crazy to younger investors, but in order to store computer data, you had to use disks that looked like this.

Speculators became so passionate that in just one year, they drove Iomega up a remarkable 2,135%, with its stock price peaking at $27 per share and the company boasting almost $7 billion in market cap. Investors in the stock started calling themselves “Iomegans.”

Iomegans were deeply committed to the company. Heaven forbid you dared to criticize the accounting practices or question the prospects of the company as journalist Herb Greenberg did. He recounted incurring the wrath of Iomegans in an article in 1998.

I remember Iomega as a prelude to the lead up to the Internet bubble. The Iomegan bubble popped in May of 1996. But Iomega was an early preview of how ridiculous investors would become in the Internet bubble.

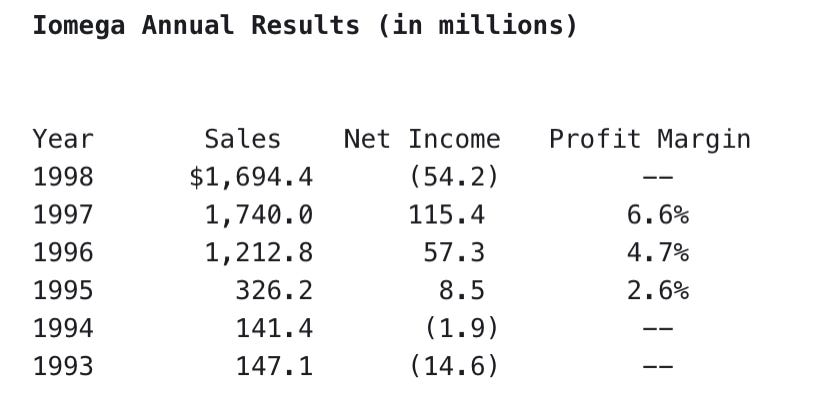

It’s interesting to see how Iomega’s stock surged and peaked way before its results peaked. This is a nice warning for all of those that think their technology stock’s growth will continue unabated.

Many years later and very quietly, The company was acquired in 2008 for $213 million, or $3.85 per share, after falling more than 85% and never really recovering.

2020 was a perfect year to demonstrate the power of identity, especially politically. How you identified politically determined how you responded to news, facts around coronavirus and even your view of the strength of the economy from one week to the next. The most stark example was polls showing how Republicans and Democrats felt about the economy before the election and the week after.

It’s interesting to me not politically, but how identity plays a role in investing. I’m watching more and more investors wrap themselves in the identity of what stocks they own or in what they will or won’t invest in.

Public Service Announcement: You are not your stocks!

After such a positive year in the markets, I see a lot of high-fiving and rooting on winning stocks as their stock prices go up, much like you would see fans cheer on a sports team as they score. What happens is that you lose sight of the fundamentals and simply become a cheerleader. None of this seems to matter when a stock is soaring. None of it matters until suddenly it does. Extreme views work in bull markets and can cause an incredible amount of financial pain in a bear market. In my experience ideologues make for poor investors or at best inconsistent investors.

Building an identity around a sector or a company can be incredibly dangerous to not only your financial health, but your psyche as well. What happens when the company’s fortunes change? It’s one thing for your sports team to lose and to be bummed, it’s another when it destroys your savings and your psychological wellbeing at the same time.

As an investor you can become blind to biases that will hurt your chances to spot negative news, management misbehavior, or know when to move on. I think the answer is to lean into criticism and be open to negative views of your investments. Dive into those arguments and ask if those views are valid. And on a regular basis check in on why you own certain investments. Be willing to challenge your own investor identity.

What you should care about is management capability and integrity, brand, growth prospects, cash flow, balance sheet and fundamental factors that make for a great investment.

It’s not just high-flying tech investors who are attaching themselves to an identity. I see value investors do it as well. It is fascinating to watch traditional value investors stick to low price-to-book or low price-to-earnings stocks, despite the advancements in computerized technology and algorithmic trading that have squeezed the alpha out of these simplistic strategies. This has relegated these traditional “value investors” to declining industries in a rapidly, changing economic world. You can sense the “identity” creeping in, when they invoke “value investing” as a religion or a holier-than-thou cause.

Another example is watching certain investors short sell right into unprecedented financial and economic stimulus this past Spring. It’s one thing if your mandate is to maintain a neutral market weighting, but many investors clearly felt the need to maintain a large short portfolio, because that was part of their investing identity. You don’t need to short and find shorts in all environments, especially an environment in which you would be betting against the full force of the US government and every major central bank in the world. Again, I think identity is at play here.

And this why I brought up Iomega. What you tell yourself matters. How rigid you are in your investing identity matters. This holds as much danger for investors now as it did for Iomegans.