“Weed is a weed.”

“It’s agriculture.”

“You can’t make money in this industry.”

This was the overwhelming narrative earlier this year with many cannabis stocks down 80% from their highs. But then a funny thing happened, the stocks stopped going down, and then they started going up. A LOT. After a year of operational struggles, several companies started to put up some great cash flow numbers. And the numbers were so good, it was hard for investors to ignore. When companies start reporting 70% gross margin numbers, it’s hard not to pay attention. In fact, those margins start to approach Cloud and Software like margins, not corn or wheat.

I’m a believer that COVID is accelerating trends that have already been happening and cannabis is no different. COVID has accelerated the demand for cannabis much like it has accelerated demand for video games and e-commerce.

Cannabis companies started reporting phenomenal demand from COVID. And while there was overwhelming coverage on the precipitous fall in cannabis stocks last year, has there been a more under-reported story than the surge in share prices this year?

Consider three of the biggest US cannabis companies:

Trulieve:

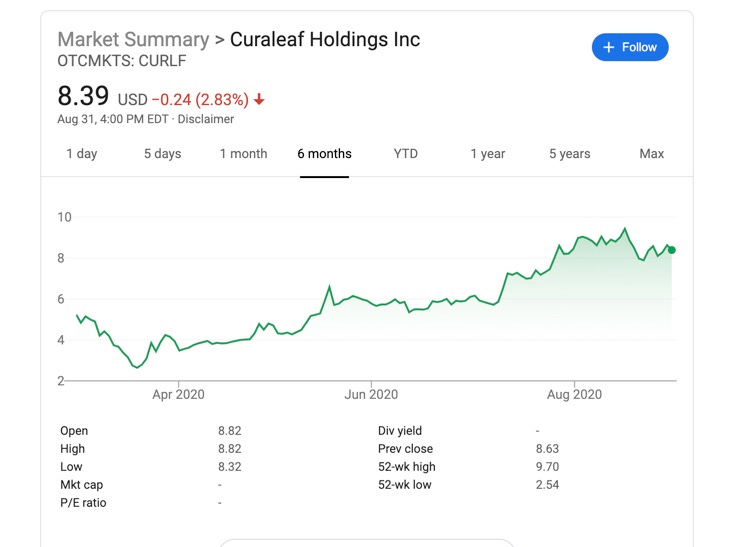

Curaleaf:

Green Thumb Industries:

Outside of Todd Harrison, who runs a dedicated cannabis money management firm CB1 Capital and has been a huge cannabis advocate, you would have no idea that cannabis has been doing so well. (I highly recommend you follow Todd Harrison on Twitter)

Similarities to the Beginning Days of Single-Family Rentals

The cannabis industry reminds me so much of the single-family rental (SFR) market’s early days. As a reminder I was the founder and CEO of a single-family rental company called The American Home that I started in 2009. We bought foreclosed homes, fixed them up and rented them out. We started with sixteen homes and built it to 2,500 single-family rental homes and sold the company in 2015.

In the early days of SFR, no one believed it was a business. Several old real estate professionals dismissed it as a trade. Several companies including ours grew exponentially in 2012-2014. And with that exponential growth came operational struggles. And the publicly traded SFR stocks struggled. During these struggles, every major SFR company replaced their COOs and several bolstered their operational management. Now, it is well established that SFR is an accepted opportunity with behemoths like Invitation Homes (NYSE: INVH) trading at a $16 billion market cap.

And this same dynamic has been happening in the cannabis space. Management teams have been replaced, bolstered and operations have been prioritized over acquisitions and unchecked growth. And it shows in the results.

Don’t Confuse US Cannabis Stocks with Canadian Stocks

If you touch the marijuana flower as part of your US-based business, you can’t list on a major US exchange. That is why most of the cannabis companies that are based here trade in Canada. However, cannabis companies that are legal in Canada can trade in the US. Get it?

But there are enormous differences in the Canadian market and the US. In the US, laws and regulations differ significantly between the states. No marijuana is allowed to cross state lines. Canada has totally different rules that make it much harder to make money compared to the US.

The mistake investors have been making is not paying attention to how regulatory rules in different states make cannabis very profitable for cannabis companies and help states make a ton of money in taxes.

So, How Does a Value Investor Like Me Play Cannabis?

I am focused on small cap value opportunities like AYR Strategies (Canada: AYR.A and OTC: AYRSF).

As a mea culpa, I first recommended this stock in April 2019 when it traded at US$15.79, when it was a SPAC (Special Purpose Acquisition Corp) called Cannabis Strategies Acquisition Corp. This was before SPACs were hip and cool like they are now. (After I recommended it the stock went up close to US$19 and then promptly fell 80%. I felt like a bagholder, but despite this bought more in April, though not enough at the lows.) Here is my original report: http://www.mindsetcapital.com/wp-content/uploads/2019/04/CSA-research-report.pdf

CSAC eventually acquired five companies in Nevada and Massachusetts and then changed its name to AYR Strategies. Why those states? Nevada and Massachusetts are two states that have a strong regulatory framework for the selling and distribution of cannabis. A strict regulatory environment should allow for higher margins.

But at first those regulations caused major delays and serious problems for all cannabis businesses, including delays in opening dispensaries, getting approved licenses, etc. And during early COVID, these were the toughest states with strictest controls to operate in. However, AYR is over on the other side of the regulatory hurdles after navigating the complicated processes. Those regulatory barriers that caused problems in the past, are now allowing AYR to earn outsized returns as it is really difficult for others to follow and get a license to grow and sell in these states.

Outside of regulatory problems, there have been two knocks on AYR. One is that compared to other larger companies, AYR is geographically constrained in just two states. The other is that the company has struggled to put up cash flow numbers they initially forecasted.

Well, now those worries are melting away. The company announced they are expanding into Pennsylvania and two other states, so by the end of the year AYR will be operating in five states. And in the last earnings announcement, the company reported that they are now at an annualized run-rate of $77 million in cash flow as of the end of July, more than double the cash flow they reported for 2019.

With several catalysts, accretive acquisitions and continued growth in their existing markets, I believe that AYR is on track to produce $125 to $150 million in cash flow next year. With a fully diluted share count of 43 million shares outstanding, its market cap is only $566 million. This means that AYR is trading at a remarkably low 3.8 to 4.5 times next year’s cash flow.

Note that the fully diluted share count includes 16 million warrants converting, which would add more than $140 million in cash to AYR’s coffers. Even if we handicapped next year’s cash flow guidance to just $100 million (which would be conservative considering how the company is expanding its dispensaries, geographies and its production), AYR even at that conservative number still only sells for 5.7 times.

This compares to similar sized companies that trade at an average of 9 times next year’s estimates and the large cap companies that trade at 12 times or higher!

AYR’s historical SPAC shareholder base has probably caused a hangover in the stock compared to other publicly traded cannabis stocks, which did not come public via SPAC. Nor has its past struggles in Massachusetts helped. Now that the company’s problems are in the past and that it is now executing at full steam, it is simply unlikely for the stock to continue to trade at such a meaningful discount.

I expect there to be more opportunities that emerge in cannabis over the coming months and years. As investors shift their attention away from big cap tech, the cannabis industry’s recent run may pale in comparison for what awaits the industry.

Hi, I just stumbled across your work today, and you have done some great work. Thanks! Now, that I got that out of the way, the only other company that I think you should look into is GrowGeneration (GRWG). They are a profitable hydroponic operator with about 30 stores and growing quickly. The only three stocks I am invested in are TCNNF, AYR, and GRWG since they are the only profitable companies that I have come across. I figure that this basket of stocks should be enough to be somewhat difersified in this sector, and so far I think it has been the right choice. If you compare the performance of these stocks compared to the marijuana ETF MJ, they have vastly outperformed the index. I was even looking at using some leverage to add even more exposure to these companies by hedging with MJ, but the borrow fees were high and you have to stomach a lot of tracking error over the short-term.