Earlier this year, Mindset Capital was appointed research consultant for the TOKE ETF by Cambria Investment Management. I wrote at the time:

“TOKE’s updated mission is to invest in the best run publicly traded cannabis companies. TOKE will be open and transparent in the way it communicates Mindset’s research, reasoning and decision-making so every investor knows exactly why and how the portfolio was constructed. And the best part is that below $50 million in assets (currently approximately $10 million), there will be no fees.”

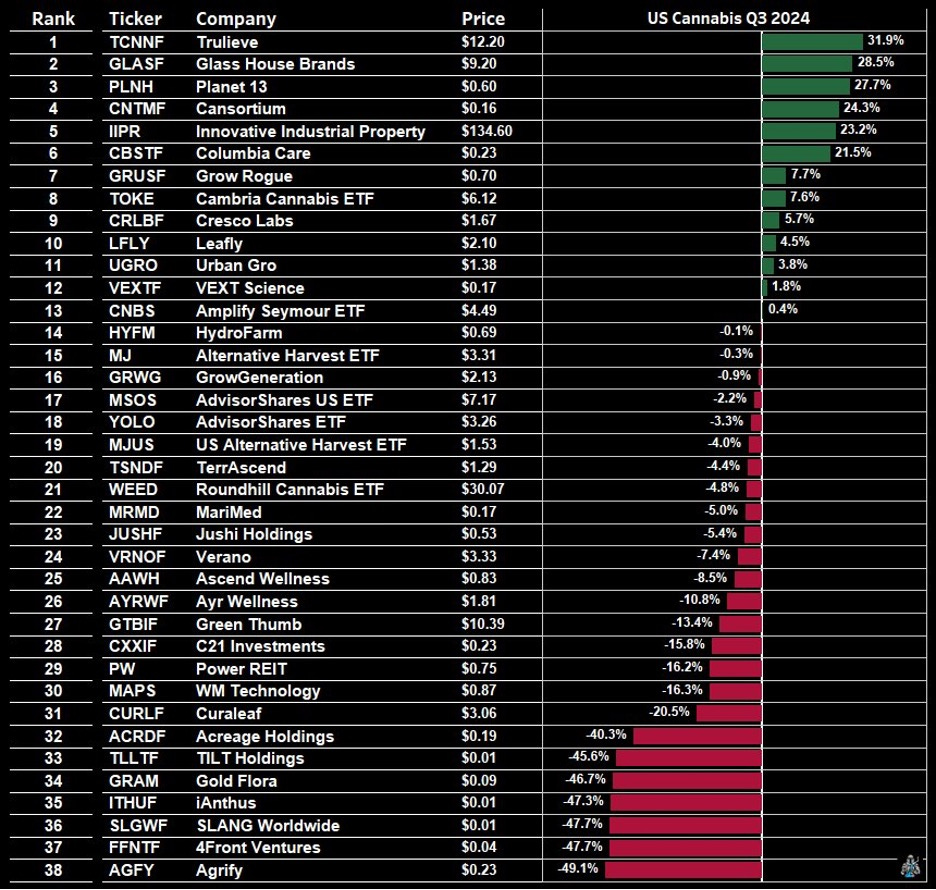

Since that time assets have grown by 78% to almost $17 million and the ETF, including dividends have outperformed other cannabis ETFs.

Today, we will dive deeper into our reasoning behind how the portfolio is constructed.

TOKE Portfolio Construction

TOKE picks its positions based on the following criteria:

1. Operational Excellence: Mindset has consistently maintained that what’s valuable in the cannabis industry is not limited licenses but operational excellence. We grade operational excellence quantitatively through Gross Profit, EBITDA and Cash Flow Margins (while adjusting for market competitiveness), consistency and qualitatively by considering management’s track record of execution and capital allocation.

2. Growth Prospects

3. Balance Sheet Strength

4. Disclosures/Transparency with Investors

5. Special Situations: We define this as companies that appear as compelling opportunities despite rating poorly on the other four criteria. This could be because of a turnaround (Vireo Health, OTC: VREOF), a company’s sum of the parts being undervalued (SNDL, NASDAQ: SNDL), a large cash balance that represents optionality (Cronos), and so on.

TOKE’s Leading Positions

Unsurprisingly to any reader of the Mindset Value Substack, TOKE’s top position now is Grown Rogue (OTC: GRUSF), the only company to receive a perfect score on all five criteria. Despite operating in the most competitive markets, Grown Rogue has some of the best margins, an excellent balance sheet, and since the company is about to start selling in New Jersey and Illinois, the company has incredible growth prospects ahead of them. In the long-term, this is a company that has demonstrated that they can be profitable under every operating condition.

Our second largest position is Glass House (OTC: GLASF). The company is operating in arguably the toughest conditions in the country in California. Glass House has increased revenue by 30% year-over-year at much higher margins compared to competitors. This while its competitors are being placed under receivership or raising capital at truly egregious terms. The company’s transparency is matched only by Grown Rogue. And a potential entry into the hemp market could be one of the best opportunities in the sector today.

Our next largest positions are Green Thumb (OTC: GTBIF) and Trulieve (OTC: TCNNF). While we are more skeptical than most of the MSO (Multi State Operator) business model, Green Thumb is clearly the best-run big company in the industry run by managers with a strong record of capital allocation. With their rock-solid balance sheet and the distress in the sector, Green Thumb will likely have opportunities to expand when others are contracting.

Meanwhile, Trulieve has demonstrated excellent improvement in its margins and will benefit tremendously if Adult Use passes in Florida.

Click here for a link to the list of all of TOKE’s holdings.

Why AYR Wellness?

AYR Wellness (OTC: AYRWF) is a special situation. The company is clearly not operationally excellent and has a troubling balance sheet. A promising rationalization and improvement of the business was underway under David Goubert before his abrupt and unexplained departure.

However, we believe that the value of its Florida assets alone could be worth many times it’s enterprise value today, especially if adult use passes in Florida. A bet on AYR Wellness is essentially a bet on Florida, as it is uniquely levered to Florida. This is a speculative position and the reason why the company is only 2.5% of the portfolio.

Jones Soda: the Only Public Way to Directly Invest in Cannabis Beverages

We are very bullish on the future of hemp beverages, and Mindset Capital even started a fund dedicated to the category, which now accounts for 15-20% of liquor store sales in Minnesota. The problem is that there are very few ways to publicly invest in hemp beverages.

Just in the past four months, Curaleaf and Tilray (NASDAQ: TLRY) have both announced that they are launching hemp beverages. I wrote in amazement that the NASDAQ appears totally ok with the fact that Tilray will be selling THC directly to US consumers and specifically discussed why I wasn’t interested in investing in Tilray.

And then there is Jones Soda (OTC: JSDA). The company is the midst of a turnaround and is revitalizing the Jones brand. And it is also seeing some real success with its cannabis beverage brand Mary Jones, which grew at an impressive 200% year over year. Jones’ newly hired CEO (June of 2023), David Knight, has an impressive beverage background that includes stints at Pepsi and Gatorade. The company just finished a private offering that leaves the company with a strong balance sheet and no debt.

Jones Soda appears to be the only real way to express a bet on cannabis beverages in the public market. While the company is an illiquid microcap and there is no guarantee that the turnaround continues, we believe it was worth starting a small position in (0.44% position). If the company continues to execute, we will continue to build our position.

And this an example of what would make TOKE invest more: tangible signs of performance, while executing with a clear strategy. We will invest more as companies execute and perform, not as they disappoint.

What TOKE Is Not Invested In

A notable absentee from TOKE’s portfolio is Curaleaf (OTC: CURLF) which scores poorly on Operational Excellence, Balance Sheet and Disclosures. While other investors may believe that the European exposure means Curaleaf has strong growth prospects, we do not believe that management has demonstrated the ability to execute on those prospects. The best example is their exit from the competitive markets of California, Colorado and Oregon, where at one point they were losing nearly $2 for every $1 they made. We believe Curaleaf’s large footprint is a problem, and not a benefit and wish the company would scale back their ambitions and focus. The recent departure of the company’s CEO and the company’s leveraged balance sheet are worrisome. Note that the stock is down 27% for the year and underperforming most its larger peers.

Another example of what TOKE hasn’t invested in is 4Front Ventures (OTC: FFNTF). With $2M in cash versus $113M in liabilities, the company is in financial distress and recently issued 50M shares in exchange in exchange for raising just $1M at 18.5% interest.

A few years ago, we toured their California facilities and were surprised to be stepping on gummies laying on the ground, while managers talked to us about operational excellence. At TOKE, we want to see proof in your results. 4Front has not yet demonstrated that it can execute its strategy of manufacturing excellence and being a low-cost leader. With all of the dilution, 4Front is down 50% for the year.

Send us your feedback and ideas.

The TOKE portfolio continues to be a work-in-progress, and we would love your feedback and ideas. What are your favorite stocks in the sector and why? What part of the portfolio do you disagree with?

Please email us at Toke@mindsetcapital.com and let’s work together to back the best cannabis companies!