In 2013, no one wanted to own Microsoft stock (NASDAQ: MSFT). It is shocking looking back, but everyone loved to poke fun at all of the things that Microsoft was doing wrong despite how profitable the company was. Just a year earlier, the company had completely discontinued its Zune products (Zune was Microsoft’s poor attempt at a competitor to Apple’s iPod). Microsoft seemingly was the laughingstock of the investing world despite its dominant position and its cash cow of a business. There was a general belief that it was headed the way of IBM.

I remember incredulously asking my friend and investor Piet Viljoen at RECM how he could possibly buy Microsoft. Didn’t he know they were a dinosaur and of all the problems that the company had? He responded that the company generated a ton of cash, sold for a low multiple and had a lot of possibility simply because investors didn’t believe in the company.

Piet wasn’t alone in his assessment, prominent investment firm ValueAct announced in April of 2013 that it took a $2 billion stake in the company. ValueAct thought that Microsoft could offer their Office software products to users who weren’t Windows customers (ValueAct Takes Stake in Microsoft).

Another memory I have from around that time was the first time Microsoft Office allowed me to save my spreadsheets, Word Documents and presentations to the cloud, allowing them to be accessed and edited on any device. It made things so easy and I was happy to pay the subscription fee to enable this feature. Why did I not buy the stock?!

Fast forward seven years and Microsoft’s stock has increased 9 times over and its market cap is around $1.5 trillion. Turns out the negativity and disbelief did not foresee the company embracing the cloud and dramatically outperforming expectations. In the midst of all of that doubt and pessimism, the company was actually in the beginning stages of transforming its business and its profitability.

I believe the same thing is happening to Nintendo, a company Western investors love to bash and chronically underestimate. Due to a lack of promotion, conservative style, some stumbles in mobile gaming, a focus on perfection and ignoring investors whims, Nintendo sells for an absurdly low multiple at the beginning stages of a massive company transition to much greater profitability just like Microsoft in 2013.

Nintendo is the Anti-Tesla in Terms of Stock Promotion

Investors, especially American investors hate that Nintendo doesn’t put much effort into traditional investor relations like other technology companies. Every investor conversation or reference to Nintendo the company revolves around how it doesn’t play the investment game that most Western investors want them to play.

Nintendo routinely issues absurdly low guidance, driving analysts crazy. Consider Nintendo more than doubled analyst estimates for its June quarter and has so much demand it cannot keep its “Switch” consoles in stock and yet refused to raise guidance for the year.

The company also takes its time as it tries to make its systems and games as exceptional as possible. This can make the company seem slow. A great example of this was the launch of its recent mega hit game Animal Crossing: New Horizons. The game was originally supposed to be released in the fall of 2019 but was delayed until March of 2020. This undoubtably hurt its fiscal 2020 (ended March 2020), but the game has now sold over 22 million units, an absurd number of units for a video game to sell in four months. Nintendo’s comments at the time? “To ensure that this game is the best it can be, we must ask you to wait a little bit longer than we thought,” Nintendo executive Yoshiaki Koizumi said during the company’s presentation in June of 2019.

But the biggest investor gripe is over the company’s slow progress in developing mobile games. Investors and analysts are obsessed with Nintendo’s lack of success with developing mobile games and have convinced themselves it spells Nintendo’s doom.

Nintendo Switch and the Apple iPhone

What I believe analysts and investors are missing is how Nintendo is trying to create an iPhone like ecosystem around the Switch console. Every analyst expects the boom and bust cycle of gaming consoles to hurt Nintendo, but they are not paying attention to the power of the cloud or what Nintendo is aiming for.

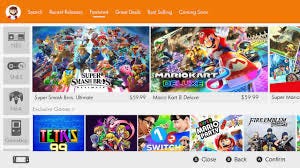

In past comments from Nintendo executives and in its own presentations, the company has mentioned their high regard for Apple and the iPhone. For the first time in a long time, Nintendo is now only working on one platform, the Switch. And just like the iPhone, Nintendo now has a basic version, the Switch and a cheaper alternative, the Switch Lite. Nintendo cannot keep either model in stock due to demand. And rumors are next year, the Switch Pro will come out.

It is my belief that Nintendo is slowly but surely building an ecosystem in which consumers will store their games on the cloud and every couple of years upgrade their Switch to a newer model just like they do an iPhone and all of their games and data will be saved in the cloud.

And the best part as an investor, is that the valuation is so low and skepticism so high that none of this potential is reflected in the stock, so if Nintendo doesn’t succeed, there is no premium I’m paying for this upside.

Nintendo Sells for 13 Times Earnings Excluding Cash and Investments

The stock at first glance looks like it is trading north of 20 times earnings. But this doesn’t take into account several important items:

Nintendo’s enormous holdings of cash ($11.8 billion)

Substantial ownership of the Pokemon Company (Pokemon is the highest grossing IP ever created)

Its ownership stake of approximately 20% of augmented reality game company, Niantic

Other investments: including a minority ownership stake in the professional baseball team the Seattle Mariners

Even assuming there is no value for its cash, its Pokemon stake or other investments, the stock still only sells for less than 19 times earnings which are in the process of exploding higher thanks to Nintendo’s digital transformation.

Digital Transformation Means Much Greater Profits Ahead

The other transformation is Nintendo’s transition to selling games digitally instead of via cartridges. Nintendo has been lagging behind in digital sales but is making up for lost ground as digital software sales now represent 56% of all sales up from 38% of sales one year ago. When you sell physical cartridges, not only must you pay for the physical cartridge, carrying inventory and shipping, but you also have to compensate retailers.

Nintendo’s latest quarterly showed an eye-popping 400% increase in operating profit. This was a direct result of digital sales surging higher. Instead of selling physical cartridges, Nintendo is now selling software through its “eShop” on the Switch.

Guess where digital sales are headed? In the future they will likely account for all sales, but by next year it could easily be 75%. What happens when your installed base of consumers soars at the same time margins soar?

There’s Even More Potential Upside

Here are a few other potential options that are not priced into a stock trading at 13 times earnings.

1. Nintendo is likely to partner with a technology behemoth to help them with the cloud. It could be Microsoft, Amazon, Apple or even Google all of whom would love Nintendo’s games on their platform.

2. Nintendo is increasingly licensing its famous characters and IP. Movies, theme parks and even LEGO toys are slowly but surely coming out.

3. Nintendo still has many “shots on goal” from future mobile games, so don’t write this off.

4. Chinese technology behemoth Tencent has partnered with Nintendo and the two are collaborating to bring the Switch console and games to China

5. Niantic, the maker of Pokemon Go, could go public, which would highlight Nintendo’s 20% stake.

None of those are in priced into the stock. As long as consumers continue to love Nintendo games and the Switch device, that’s all that matters. In the long run, the stock will reflect the company’s enormous upside.

Oh, and one more thing. In April, ValueAct the same firm that invested in Microsoft in 2013, announced a $1.1 billion stake in Nintendo. ValueAct sees an opportunity in the company’s transformation with digital software sales and its licensing potential to grow into a bigger entertainment company. I’m betting that history may be repeating itself.

P.S. Big thanks to Ryan O’Connor with CrossRoads Capital for helping me think through Nintendo.

P.P.S. For a great background post about Nintendo and how people misunderstand the company, see this excellent Matthew Ball post (Matthew Ball on Nintendo).

I really enjoy reading your stuff. Just discovered you recently. How do you view Nintendo's valuation today?

Have you read Range by David Epstein? Chapter 9 discusses Nintendo's culture. Interesting read.