At the pace that Nelnet (NYSE: NNI) is buying back shares, in nine years there will be no free float shares available, and Nelnet will essentially be a private company owned by management. And right now, no one appears to be paying any attention.

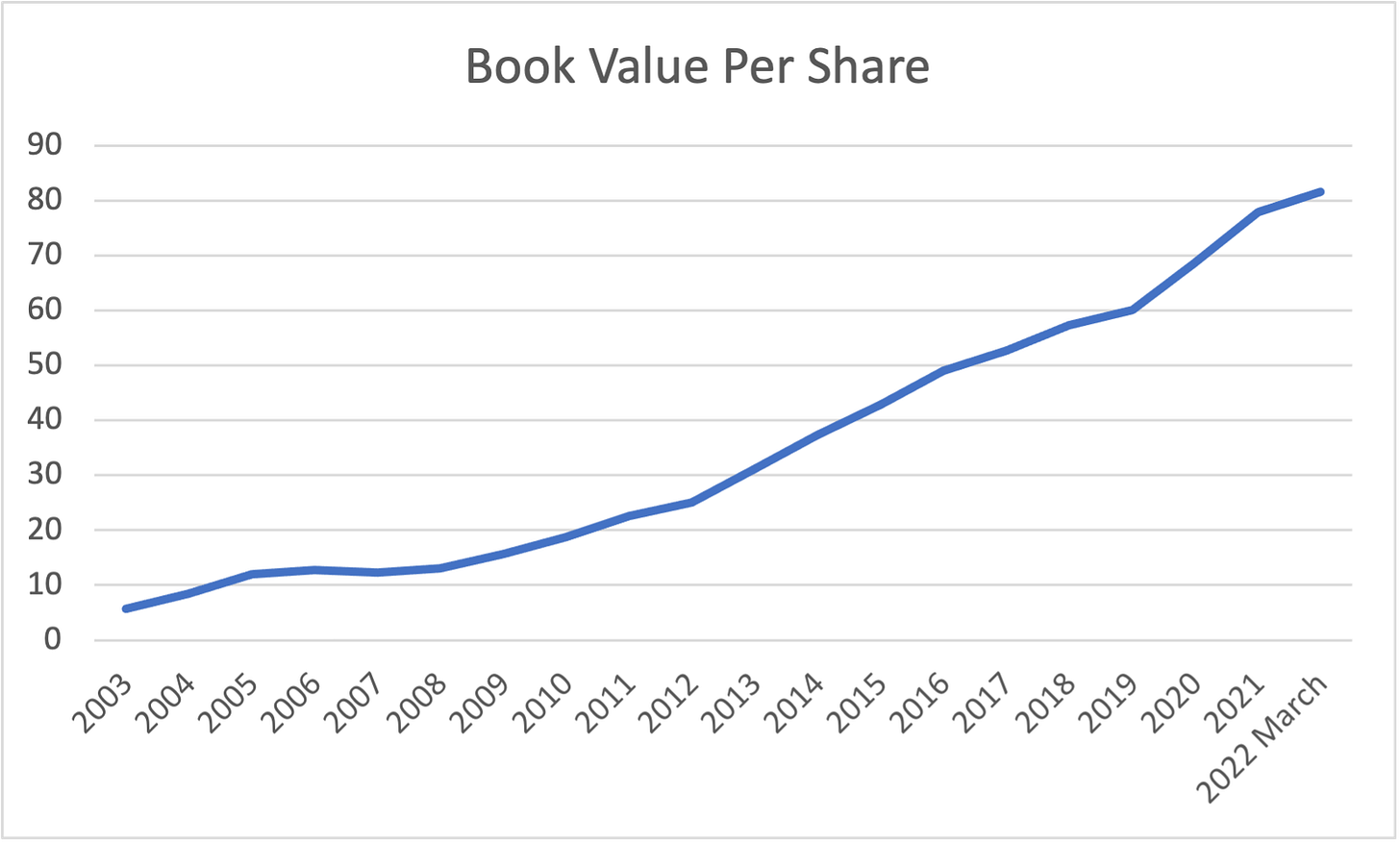

Nelnet and its operational performance have been something to behold. The company has compounded book value per share at over 17% annually since going public in 2003 all the while successfully navigating the great financial crisis and COVID. Here is a chart of the company’s book value per share since the company went public:

And here is the long-term stock price:

So, why does the stock price chart look less compelling than the book value chart? Well, the company went public to much fanfare at EIGHT times book, a very high valuation for a financial company. It took years to work off that high valuation, but now, the company trades at approximately ONE times book value, all due to compounding value over the years and a lack of appreciation for the value the company has created.

I have written about Nelnet first in a detailed report in which I called the company, “The Quiet Technology Compounder.” Then I wrote about the company’s stellar record and called the chairman Mike Dunlap, the “Oracle of Lincoln.” I followed that up with an article about one of the company’s hidden assets, HUDL (Nelnet owns a 20% stake).

I’ve been baffled as to why the company does not have more of a following and why its valuation is so low despite its clear outperformance. And despite strong earnings, continued growth in book value and a balance sheet that is flush with cash, the stock price has recently been stuck in the mud. I estimate that Nelnet’s true market value is something closer to $130 than $84 per share.

Apparently, management (which owns approximately 50% of the company) has been wondering the same thing as I have. As excellent capital allocators, management knows a thing or two about creating value and right now they are buying as many shares as they can every day. The company is buying back approximately 1% of the company every quarter right now. And for the first time I can recall, highlighted the buybacks in their latest earnings press release.

During the first quarter of 2022, the company repurchased 380,053 Class A common shares for $32.9 million ($86.56 per share). Subsequent to March 31, 2022 (through May 9, 2022), the company purchased an additional 253,838 Class A common shares for $21.2 million ($83.62 per share).

And they have plenty of cash to continue to buy back shares because not only do they have $1.8 billion in cash, but with the company’s student loan book in runoff, the company will see a another $775 million in cash hit their balance sheet in the next 2.5 years, with $240 million hitting in just the next three quarters. And this says nothing of what the company produces in free cash flow every year.

How long will the market ignore Nelnet, its incredible track record of value creation and the accelerating buybacks? I’m not sure, but I reached out to the Chairman, Mike Dunlap to see if he would do an interview to answer some questions about their philosophy, buybacks, and this environment.

Nelnet management studiously avoids the limelight. The company does not hold quarterly earnings calls and management comments seem to be limited to their annual letters (which are excellent, I recommend you read the last one!). So, it was very exciting when Mike Dunlap agreed to a written interview of questions.

Do I think the company will buyback every share and essentially go private? Of course not. At some point the market will start to notice and reward the company like it has other companies with aggressive buybacks like Autozone (NYSE: AZO) or Berkshire Hathaway (NYSE: BRKB).

I think the company deserves not only a much higher valuation, but more analysts and investors studying exactly how they have built such a great company and great track record. And a great place to start is to pay attention anytime there is a chance to learn from Nelnet’s Chairman, Mike Dunlap.