Opportunity in Small Cap Energy: Black Stone Minerals

An 88% Increase in Quarterly Distributions?!

In the midst of an energy industry collapse, one energy stock, Black Stone Minerals (NYSE: BSM) just raised their distribution by 88%. This is confusing because while the price of oil has recovered from temporarily trading at negative prices in the spring, the news could not be worse: bankruptcies are announced weekly, approximately one hundred thousand jobs in the sector have been lost, and drilling activity is near record lows. For the companies that are surviving, capital expenditures are being cut by a minimum of 40-50% and the sentiment is quite pessimistic.

What is even more interesting is the rather muted reaction to the good news. BSM jumped 10% on the news and that was all. The stock is still quite cheap and offers a low risk way to invest in oil and natural gas prices returning to prices above the cost of production over the next 12 to 24 months.

So, what is Black Stone and what is going on?

Black Stone Minerals is an Oil & Gas Royalty Trust

Black Stone Minerals is a publicly traded master limited partnership (MLP). MLPs are publicly traded partnerships that allow investors to receive tax benefits similar to Real Estate Investment Trusts (REITs) such as only paying tax once as long as they distribute all available cash to investors.

There are all kinds of energy MLPs with the majority of them focused on pipelines or other energy infrastructure. Black Stone is different in that it is the largest publicly traded oil and gas royalty trust. Black Stone owns and then leases out mineral rights to oil and gas producers and then gets paid a percentage of whatever oil and gas comes out of the ground. Typically, the payment is around 20%. Black Stone owns mineral rights on over 20 million acres of land (BlackStone Minerals Map).

Owning Black Stone is a low risk way for investors to invest in the energy sector because the company has minimal capital expenditures. Sometimes the company will go out and acquire new mineral rights and the company has some wells it has working interests in, but even that capex is not very high. Consider that in Q1, the company only spent $3.5 million on capex compared to its $76 million in net income.

Owning royalties on valuable mineral rights is simply a great business to be in as long as energy prices are not plunging.

Why is the Stock Down So Much from Its Highs?

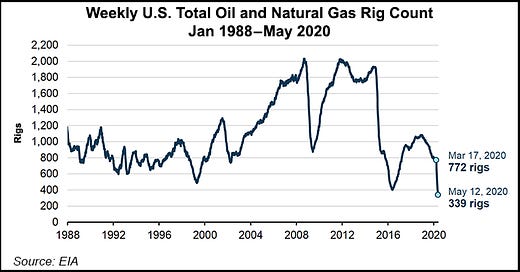

Black Stone is down for a number of reasons. First, it is not immune to the depression in the energy sector and only earns money when producers are drilling and producing on its properties and drilling is down by a lot.

Second, the company is very conservative and when the economy halted in March, Black Stone initially cut its distribution by over 70% to conserve cash, pay down debt and see how things would play out.

Third, MLPs are often heavily owned by retail investors who are very yield conscious. When dividends were cut, many investors bailed. There has also been carnage throughout the sector especially because MLPs are normally heavily levered (Black Stone is not) and because of industry weakness almost all MLPs have been thrown out together.

Conservative Balance Sheet and Conservative Management Owns a Lot of Stock

Management responded to the coronavirus by ruthlessly cutting the dividend, initiating a few asset sales and conserving cash. While the dividend was initially slashed by 73% to $0.32 per unit annually, a little more than three months later, after the dust settled, the distribution is back up to $0.60 per unit.

The company had $394 million of debt at the end of 2019 and through quick actions now only has debt of $160 million as of the last asset sale. This is extremely conservative positioning for a company with $1.5 billion in assets.

I believe management is being ultra-cautious and wants to understand how drillers are going to respond longer-term before they raise the dividend any higher. Management has to be worried that most exploration and production companies are sitting on mountains of debt. No one knows what the economy, COVID or energy prices will do in the short term. I believe management is being very careful to make sure that it never has to cut the dividend again.

The stock’s dividend is still half of the annualized dividend of $1.20 per unit from February, but management indicated that the new dividend is covered 2.1 times, so theoretically the company could be paying more than the February dividend at $1.26 annualized per unit.

Management, insiders and the family of the CEO, Thomas Carter, own more than 30% and are very aligned with shareholders.

But while management is being cautious and the price of oil’s bounce has stalled out around $41 per barrel, the outlook is actually getting brighter for natural gas.

Natural Gas Skew Could Benefit From Oil Shale Collapse

Black Stone’s mineral rights are heavily concentrated in natural gas, which has been in a multi-year bear market. Why? The problem for natural gas is actually oil shale. Natural gas is produced as a by-product of oil shale production. The explosion in oil shale production in the last few years has caused natural gas production to soar, crushing natural gas prices. Now with oil shale getting decimated and so many natural gas producers struggling, the pressure is coming off.

What’s fascinating about natural gas is that the long-term outlook is much rosier for natural gas than for oil. Renewable energy should require substantial fossil fuels going forward to build a renewable power infrastructure and there are problems with the consistency of renewable energy. Since there doesn’t appear to be much demand for nuclear power plants, natural gas should be an integral part of power production in the U.S. going forward.

The forward curve in the futures market currently shows how prices are expected to be much higher in the future for natural gas. After being stuck below $2 per mcf most of the year, the curve is showing that after November, natural gas is expected to trade at $2.5 per mcf to $3 per mcf into 2022 (Natural Gas Curve).

Those prices should be solidly profitable for drilling and production and Black Stone’s natural gas related cash flow should recover substantially in the next 12 months.

Valuation

Despite such a low level of risk and a bright future thanks to its natural gas exposure, Black Stone is trading like a distressed asset. The company now sports an 8.2% dividend yield and a free cash flow yield of over 17%. For a company with such great assets, low capital expenditure needs and low levels of debt, this is simply an astonishing return in a zero-interest rate environment.

If oil and gas return to prices above the cost of production, Black Stone’s distributions could easily return to $1.50 per unit. At that distribution level, the stock should easily return to the $15 to $20 price range from 12 to 18 months ago.

Summary

Do I know where oil and gas prices are headed in the short term? No. Do I believe that oil and gas will eventually trade above the cost of production. Yes. So, why not earn an 8% yield with a conservatively run partnership and an aligned management team and wait for good things to happen. Worst case, I clip the dividends, best case the stock could more than double from current share prices.

Aaron, take a look at DGOC (diversified gas and oil). Great yield (~10%), even greater FCF, strong balance sheet. Cheap due to overall oil ang gas names market sale-off and orphan shareholder base (assets in USA, trading at LSE)

Excellent article, do you have any thoughts on Viper Energy (VNOM)? I think it is also worth a look!