Still Vireo Bullish on Cannabis

Vireo Growth’s Transformational Merger

When was the last time a publicly traded company raised capital at a stock price that was 149% higher than the last closing trading price?

I have been investing professionally for over 25 years, and I can’t remember a time that such a thing happened. But it happened today (Wednesday the 18th) to Vireo Growth (OTC: VREOF), when the company announced a transformational merger with four other companies and a $75 million equity offering to be done at approximately $0.63 per share. The previous close of Vireo was at $0.25 per share. Even more remarkable is due to the dire straits of public cannabis investing and the stock market selling off late in the day is that the stock only closed at $0.50 per share.

And here in a nutshell is the opportunity in cannabis. Since there is very little institutional investment involved in cannabis and thus very little due diligence or research, the market prices of publicly traded equities are potentially trading at wildly different values than the fundamental value of the company or what strategics think they are worth.

In one big transformation, Vireo is going to merge with four different companies, be injected with a huge amount of capital and the new company will be profoundly different than the old one. The “old” Vireo was very much undercapitalized. It was not making enough to cover its interest costs or its expansion into New York and was simply a play on Minnesota, which should be one of the best markets in the country when adult use is launched in 2025.

Now we have a company that in 2024 should earn approximately $400 million in revenue and close to $100 million in EBITDA and has a relatively easy path to significant growth the next two years to over $600 million in revenue and $200 million in EBITDA. This should not be such a stretch considering adult use is launching in Minnesota and they will be one of the grandfathered in vertically integrated operators and they now have the capital to fully launch in New York.

But the best part is not those forecasts, but how the merger is structured in a very advantageous way for current Vireo shareholders. There are strict lockups on the merger shares starting at 12 months and going until 33 months from the merger. And more importantly, if the companies being acquired don’t hit their forecasts, there are significant clawbacks of the consideration they will receive.

So, current Vireo shareholders will be in a company that is much stronger financially and more diversified, and also protected if forecasts prove to be too optimistic.

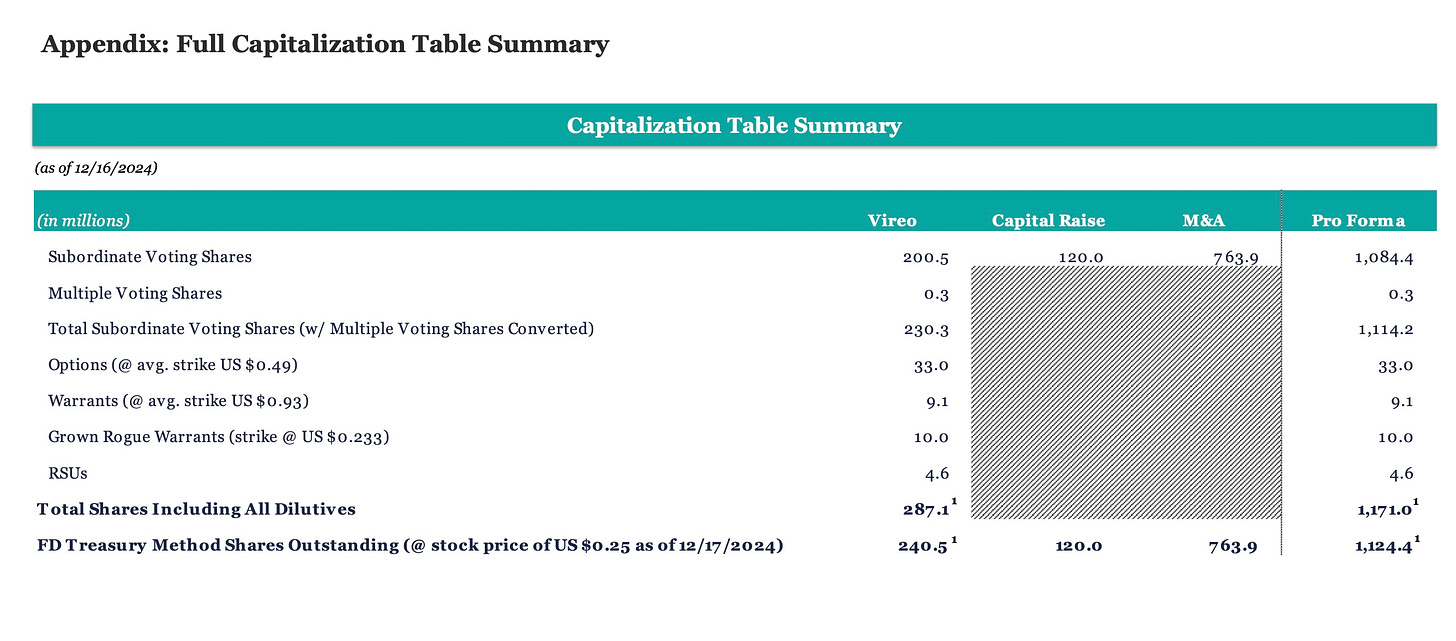

Also a benefit for current Vireo shareholders is that most of the fully diluted shares (approximately 80%) will be locked up for some material amount of time (120 million shares from the equity offering will have a six-month lockup). This means there won’t be a ton of selling pressure from either the offering or the merger any time soon.

Another point is who is making this deal happen. Chicago Atlantic is the largest equity holder in Vireo and the driver of this deal. This is remarkable because they have primarily been debt investors. For them to go all in on Vireo and this opportunity is telling. Normally, debt investors are considered to be much smarter and more risk averse than us dumb equity investors. Chicago Atlantic clearly sees an opportunity to roll up the industry at a distressed time.

The Vireo news today just shows how much alpha there is in cannabis. The idea that a company can raise capital at a price 149% higher than its last closing price should be a clarion call to investors that a lot of opportunities are there for those willing to do the work and figure out which companies have value, and which ones don’t.

A few closing random thoughts:

1. Marc Hauser has his own post on the transaction, and I highly recommend it.

2. Grown Rogue (OTC: GRUSF) is a beneficiary of this deal as they own 10 million warrants in Vireo as part of the partnership they had struck with them.

3. This is potentially negative news for Verano (OTC: VRNOF), which is being sued by Vireo for wrongful termination of their merger. Chicago Atlantic has clearly made a bet on the equity value of Vireo and now has deep pockets to finance Vireo’s lawsuit. But even worse, is that Chicago Atlantic is also a significant lender to Verano. I have no inside knowledge here, but I could see a scenario where Chicago Atlantic squeezes Verano. In irony of ironies, I could see the new Vireo ending up buying Verano and merging it into its budding empire, but at a valuation that may not make current shareholders happy. But who knows, this is all speculation for me.