The Fire Monopoly

Perimeter Solutions’ Sizzling Flame Retardant Business

After a relatively quiet fire season, California is now aflame. Soaring, record breaking temperatures and a prolonged dry season has left California a tinderbox ready to explode. And this weekend numerous fires broke out.

Here is a map of the different fires in California right now.

The reasons for these fires are numerous. The most important is that California, like much of the West, is in the midst of a historic drought. A combination of climate change and a second consecutive La Nina year, which normally leads to a drier year for the West of the US, has led to bone dry conditions across the state.

None of what I’m telling you is new, but what you may not know is that there is a business with a monopoly on fighting these fires with an almost insurmountable moat that has recently been taken public by one of the great compounders of all time.

Let me introduce you to Perimeter Solutions (NYSE: PRM), which last year went public via a SPAC raised by Nick Howley, the founder of Transdigm (NYSE: TDG). If you don’t know about Transdigm, you should. Since March 2006, Transdigm has soared by over 2,300% and its founder and now chairman of the board is considered one of the great compounding CEOs/chairmen of recent memory. The chart outside of COVID is a thing of beauty.

What made Transdigm such a great investment is they built a business around being the supplier of hundreds of thousands of small, highly engineered low-dollar aircraft parts that may represent a miniscule part of the aircraft or maintenance but are critical in nature. This has given Transdigm pricing power to the extent that the company has been able to realize EBITDA margins of approximately 50%. There was a good writeup from 2020 of Transdigm from Value Investors Club.

And I believe that Perimeter shares similar qualities that made Transdigm such a great investment.

Perimeter’s Monopoly on Fire Retardant

To supply fire retardants to government agencies, every product needs to pass through a series of tests, after which it is added to the US Forest Services ‘Qualified Product List’. For several decades, the only company on this list has been Perimeter Solutions.

Recently, a company called Fortress received conditional approval from the US Forest Service. Assuming they clear the final hurdle by passing the field test- Fortress would then bump into an even bigger competitive problem - Perimeter’s logistics network.

There are 150 firefighting bases across North America, any of which can be urgently pressed into action at any point. Perimeter has the ability to deliver to any of them within 8 hours of factory production. This is critical as the government airport only carries enough inventory to fight fires for one day, whereas the average wildfire lasts for 37 days. Further, retardant chemicals are not compatible, meaning the retardant tank needs to be cleaned thoroughly before reloading every time, something which agencies would be loath to do in the middle of fighting a wildfire. Thus, an agency cannot dual-source retardants, and would have to fully commit to an upstart competitor over a company that has proved its reliability and ability to deliver over the past 50 years, including during employee and supply chain shortages over the recent years. Given the risk-averse nature of government employees, the catastrophic consequences of a wrong decision and the relationship that Perimeter enjoys with the agencies, that is a difficult barrier to say the least.

But Perimeter is more than just a firefighting supplier. About 65% of Perimeter’s revenue comes from air bases that have been fully outsourced and are run by Perimeter employees. Another 15% to 20% comes from Mobile bases, set up in remote locations. Even in the remaining 15% of the airbases, over the years, they have installed their equipment, meaning they are more than just a supplier.

Thus, even after joining the Qualified Product List (QPL), a competitor faces several years of struggle and uncertainty where they will, at best, grab a few percentage points of market share. Meanwhile, by virtue of being the sole supplier of an input that accounts for only 2% to 3% of total fire spend, Perimeter has been able to consistently raise both its volume and the prices. Here’s what the CEO of Perimeter had to say in a recent earnings call:

In addition to mid- to high single-digit volume growth, we expect to deliver consistent price growth in our Fire Safety business to reflect the increasing value we provide to our customers.”

Rising Number of Wildfires

Every year seems to bring new headlines of disastrous wildfires in some parts of the globe. In the US, the area burned by wildfires has increased nearly 3x over the past three decades.

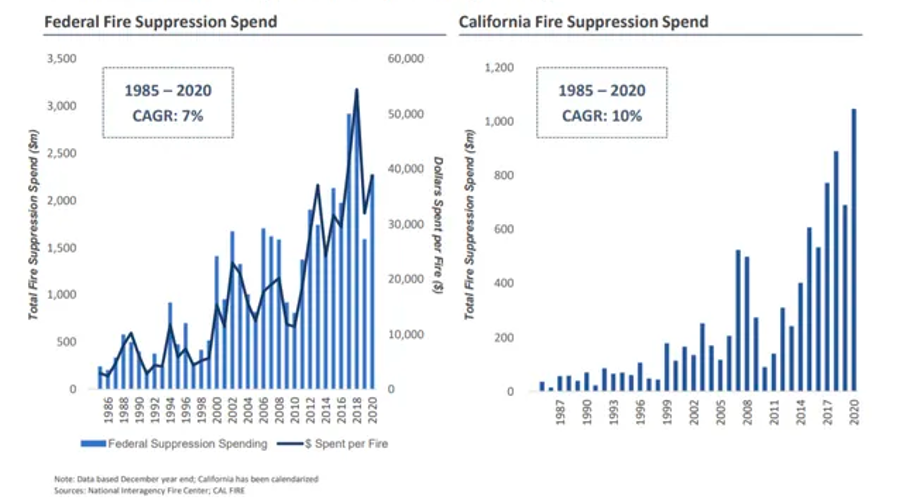

Increasing urbanisation means wildfires now pose a greater threat to human lives and infrastructure. Consequently, government spending on wildfire suppression has consistently grown.

As agencies look to attack fires early and aggressively, a large chunk of this spend is going into buying more and larger aircraft fleets with an ever-increasing capacity to carry and drop fire retardants.

These three factors- more fires, more urbanisation, and more retardants per fire have led to a 10% CAGR in Fire Retardant volume delivered to firefighting agencies from 2009 to 2020. And since Perimeter has a monopoly, only one company has reaped all the benefits.

International Opportunity for Fire Retardants

As the US Forest Service’s QPL is also the standard across much of the rest of the world, I am bullish about Perimeter’s international prospects, especially with the recent highly publicised fires in Europe. With wildfires rising globally, Perimeter expects strong international growth as more countries build out aerial attack capability and become Perimeter customers.

This is what Perimeter said on their second quarter conference call:

Greece has historically used cheaper and less-effective foam products rather than retardant to combat wildfires. As their wildfire problem grows in severity and after significant consultations between the Greek authorities and Perimeter Solutions this year, Greece has contracted for one of our mobile retardant bases and the associated fire retardant for the 2022 fire season. This is often an important step toward more meaningful adoption of Perimeter's fire-retardant products and services.

We've also made significant progress this year in Italy. For the past several years, Italy has also primarily used cheaper and less-effective foam products, with minimal and sporadic use of retardant. After concluding that retardants are the superior solution to their growing wildfire issues and after significant consultations with Perimeter, Italy made the decision to switch their entire aerial firefighting effort to retardant starting this year.

Furthermore, Italy is implementing a model very similar to the full-service model in the United States, where, in addition to providing the fire retardant, Perimeter Solutions also provides the logistics, equipment and staffing necessary to run a national retardant operation. We continue to be very positive around the long-term growth potential of our international wildfire business. Link to the earnings call transcript.

Prevention Market Upside

As the world adjusts to longer and fiercer fire seasons, individuals and businesses are going to look for preventive solutions. Here too Perimeter is well placed thanks to a smart acquisition of LaderaTech. Its product Fortify is a gel that can be applied to high-risk areas and can withstand one inch of rain or more. This is highly valuable especially for utility companies that face huge liabilities from potential fires they may cause, and are investing billions of dollars in fire prevention. This is a potential market north of $2 Billion a year, and a much more recurring revenue stream than Fire Retardant business which can be highly seasonal depending upon the severity of fires. While the company has already announced a few deals for Fortify, it has down played its immediate prospects.

The LaderaTech acquisition shows Perimeter’s attractiveness as an acquirer to would-be innovators in the fire safety industry. By itself, LaderaTech would have struggled to get on the QPL. Perimeter successfully used its relationship with the regulators and capital to bring the product to market, where it now has a much brighter future than it ever did under LaderaTech.

Climate Change and Fighting Fires

Due to climate change and the emphasis on reducing carbon, it makes sense to treat wildfires more aggressively and not let them burn out of control. President Biden and US Forest Service have come out with aggressive plans and big spending increases for firefighting and prevention. All of this should benefit Perimeter.

Climate Change not only brings more extreme weather and longer more dangerous fires, but also drives a need to be more aggressive in fighting wildfires when they happen.

Oil Additives Business Sees New Life

Perimeter has another division called oil additives that represents about 30% of revenue and 15% of EBITDA. The main end market is engine oil. The oil additives business provides phosphorus pentasulfide, which is a key ingredient in automotive engine oil.

Up until Q4-21, Perimeter had forecast flat revenue and EBITDA growth for its oil additives. In Q1-22, investors were pleasantly surprised by a 50% year-over-year revenue increase, and a 97% increase in EBITDA. While management didn’t share too much information, the potential growth of the oil additives business is a cherry on top of what was already a very tasty cake.

Model

SPAC Economics Confuse Investors

Perimeter was a SPAC (EverArc) formed in London, England by William Thorndike, author of the book, the Outsiders, and Nick Howley of Transdigm. The SPAC compensation structure is unusual. The SPAC sponsors are entitled to an annual 1.5% asset management fee and get 18% of the upside and they get paid in shares. Last year, there was a big charge against earnings for this setup and it has confused investors.

Here is what investors should care about going forward. Sponsors of the deal only get incentive shares if the stock closes the year or any future year above $13.62 per share, or almost 40% higher than current prices. This is due to the high-water mark, as they get 18% of the upside in share price from one year to the next, but only if it is higher than the previous year’s ending share price. For someone like me who runs hedge funds and invests in funds, this is an easy structure to understand, for public investors this is unusual.

Drawbacks

While over the long-term, Perimeter’s revenue growth seems inevitable, it will experience seasonal fluctuations depending upon the severity and length of a fire season. Fire Safety Revenue will typically peak in Q2 and Q3 and slowdown in Q4 and Q1. And revenue could be chunky and depends on fire activity.

Also, as mentioned above, the sponsors of the SPAC get a share of the upside. I think this aligns them well to increasing the stock price, but it may turn other investors off.

There is a competitor that is working on a competitive solution but they have not gotten approval from the US Government and frankly, I’m not sure how they could get their flame retardent onto airplanes considering that Perimeter runs the planes and the equipment on the air bases. But, it is always possible.

Summary

Perimeter has a monopoly on fighting fires, in a world of climate change and explosive wildfires. Small advantages in pricing power have been shown to bring incredible returns to investors as Transdigm has shown us. I think the same may be in store in the long run for investors in Perimeter.

P.S. I’m not the only one who has written up Perimeter. Check out these other writeups as well.