The First Pitch

Trump Orders Cannabis Rescheduling

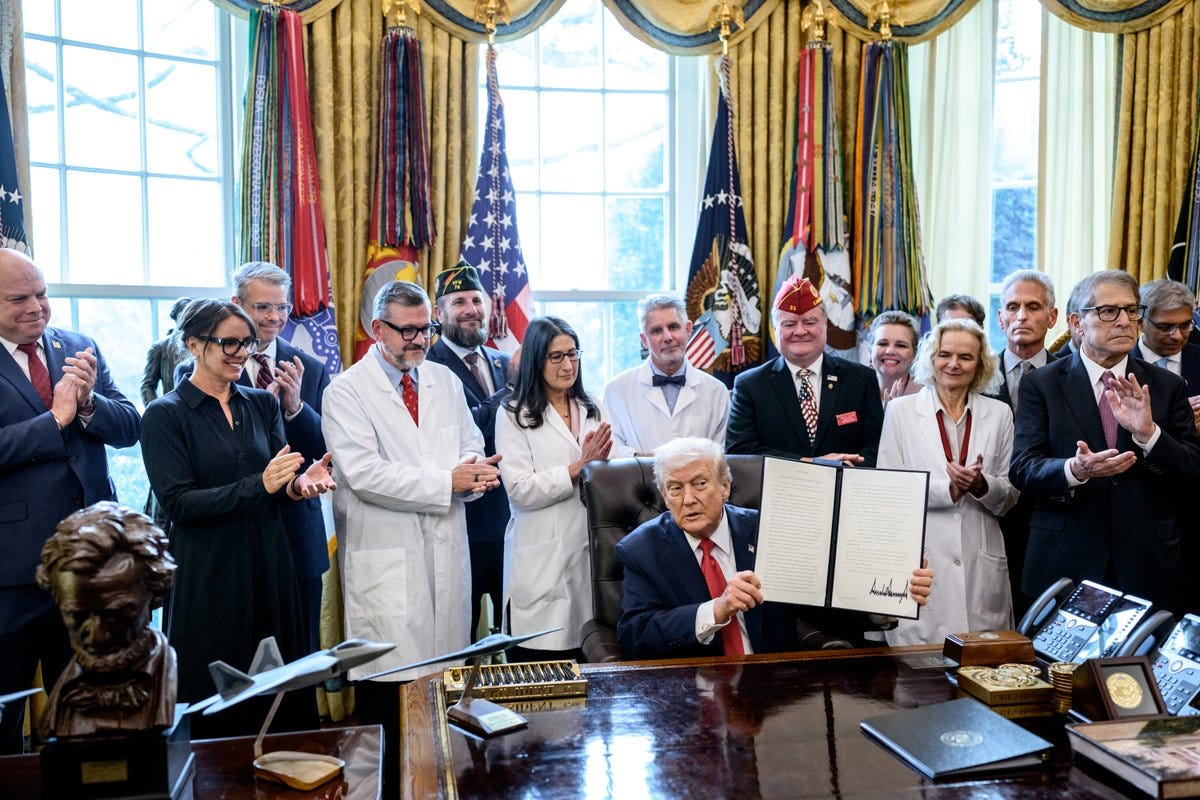

Last Thursday, President Donald Trump signed an Executive Order (EO) directing Attorney General Pam Bondi to “take all necessary steps to complete the rulemaking process related to rescheduling marijuana to Schedule III of the Controlled Substances Act (CSA) in the most expeditious manner in accordance with Federal law.”

In plain English: Trump is instructing the Attorney General to move cannabis to Schedule III.

This is a historic moment for U.S. cannabis policy—arguably the first meaningful federal shift since cannabis was placed into the CSA as a Schedule I substance, alongside drugs like heroin.

Without getting lost in the procedural weeds, I now expect cannabis to be officially rescheduled sometime in the first half of next year.

The question I’ve heard most from investors and friends is: What does this actually mean? And just as importantly: why have so many cannabis stocks dropped since the EO?

After a few days to think through what happened, here are my main takeaways:

1) The Executive Order (and ceremony) were surprisingly pro-hemp

I was shocked at how pro-hemp the executive order—and especially the messaging around it—seemed to be. I expected this to be mostly about regulated cannabis. Instead, much of the emphasis was on hemp and CBD.

To go from Mitch McConnell allegedly slipping hemp ban language into a government funding bill a month ago, to the White House speaking positively about hemp-derived products, is real whiplash.

2) “Full-spectrum” matters, and they leaned into it

President Trump, HHS Secretary RFK Jr., and Dr. Oz (as Administrator for the Centers for Medicare & Medicaid Services, CMS) repeatedly mentioned full-spectrum CBD—which is meaningfully different from CBD isolate.

Full-spectrum CBD includes multiple cannabinoids, terpenes, and small amounts of THC. Many believe this combination improves therapeutic effects via the “entourage effect.” In other words: full-spectrum products are often viewed as more effective than isolate.

One line from the written EO stood out:

“Adding complexity is the fact that some full-spectrum CBD products will once again be controlled as marijuana under the CSA when section 781 of Public Law 119-37 goes into effect because they contain THC levels above the per-container threshold set by that law.”

Translation: the White House is effectively signaling that the hemp ban language passed by Congress in November needs to be reworked, because it conflicts with what they say they want—particularly for full-spectrum CBD.

Even more importantly, under certain interpretations of the language, it may be impossible to produce CBD without producing THC as a byproduct.

Bottom line: I now think the White House may push Congress to delay, revise, or eliminate the hemp ban language—and replace it with proper regulation—because the current framework clashes with the policy direction they’re publicly endorsing.

3) Medicare reimbursement for full-spectrum CBD could be enormous

One of the biggest shocks wasn’t in the EO itself—it was Dr. Oz’s announcement. He said CMS will launch a pilot program in April in which Medicare and health insurers reimburse seniors up to $500 annually for full-spectrum CBD products for health and wellness. The stated goal is to expand the program broadly.

If this were expanded to all seniors, it would be massive—potentially larger than today’s U.S. cannabis industry.

4) Tax relief should help—but may be fleeting

Moving from Schedule I to Schedule III should provide relief from 280E, which currently prevents many normal business deductions.

That said, we’ve been skeptical about the long-term value of 280E relief. Over time, much of the benefit may get competed away and passed through to consumers.

We’ve seen versions of this before. When California eliminated its cultivation tax, the benefit didn’t sit with operators for long—prices fell, and consumers captured a large share of the savings. Rescheduling could accelerate price compression.

Yes, lower prices can expand the market and grow sales—but unit economics still matter. There are public cannabis companies with weak business models or structurally high expense structures that tax relief won’t fix.

Also note: many U.S. cannabis companies already aren’t paying meaningful 280E taxes (for various reasons), so rescheduling may not dramatically change their underlying economics.

We’ve previously discussed companies like Planet 13 (OTC: PLNH), which appears to have serious structural issues. A tax break doesn’t solve steep revenue declines or weak gross margins.

5) The “big” questions are still unknown

Key issues remain unresolved:

Can U.S. cannabis companies list on the NYSE or NASDAQ?

Will credit cards work at dispensaries?

Will federally regulated banks begin banking cannabis broadly?

What happens with interstate commerce?

Do institutional investors (e.g., major private equity) enter in size?

The honest answer: we don’t know yet.

6) Fast money arrived, didn’t get fireworks, and left

A lot of people were surprised that cannabis stocks sold off immediately after the announcement and kept sliding through Monday—nearly erasing the move that began when rumors started circulating.

In my view, this was “fast money” behavior. Many traders were positioned for an instant flood of capital and surging stock prices. When that didn’t materialize immediately, they exited about as quickly as they entered.

We remain firm in our belief that federal reform is the start of the game, not the end.

7) Where’s the growth?

Another headwind: many U.S. public cannabis companies are showing flat or negative growth, and very few look set up for meaningful growth in 2026. Many operate in limited-license markets where high prices are coming down. Meanwhile, the broader stock market is paying for growth—not excuses.

This is one reason I’ve been so focused on Minnesota. It’s one of the only newer adult-use markets with real runway, and its structure suggests it may remain short on flower production for a long time.

Minnesota likely needs roughly 1 million additional square feet of cultivation, requiring $300–$500 million of capex—and that’s not happening overnight or any time soon. In the near term, that dynamic benefits operators positioned to supply the market, including Green Thumb (OTC: GTBIF) and Vireo (OTC: VREOF), and eventually Grown Rogue (OTC: GRUSF).

Minnesota may end up separating the growers from the pretenders.

8) Exporting could become a meaningful opportunity

Ketamine is a Schedule III drug, and it is exported internationally from the U.S. More broadly, Schedule III substances can be exported if exporters follow DEA registration and export requirements (permits and/or export declarations depending on the substance).

We’ve already seen Canadian cannabis companies benefit from exports to Europe—improving pricing and helping absorb excess supply.

Could something similar happen with U.S. cannabis? Possibly. And if it does, low-cost, high-quality producers could be major beneficiaries—think operators like Glass House (OTC: GLASF) and Grown Rogue.

9) Mammoth: a clear beneficiary of the “health and wellness” shift

One of the biggest winners from last week’s messaging may be one of our largest investments: Mammoth Distribution, a house of brands that includes one of the strongest health-and-wellness brands in cannabis: Papa & Barkley.

Papa & Barkley was created by a son trying to help his senior-citizen father with cannabinoids. If the federal government truly starts pushing cannabinoid-based health and wellness—and especially if reimbursement becomes real—the long-term opportunity for that brand could be enormous.

I’m as bullish as I’ve ever been—and I continue to be amazed by how few long-term investors remain in cannabis. There’s still too much focus on getting rich quickly by trading headlines, and not enough focus on unit economics, operational execution, and long-term pricing dynamics.

That disconnect continues to create opportunities—especially in private companies positioned to win over the long term.

Gratitude to the activists

I also want to acknowledge the activists who fought for years to move cannabis reform forward. Among the people I know personally, I want to recognize Weldon Angelos for his work behind the scenes, and attorney Shane Pennington for pushing back against DEA efforts that could have derailed rescheduling.

Summary

I continue to believe the future is bright for cannabis, and last week’s announcement was a major milestone. It didn’t make everyone instantly rich—because it isn’t the endgame.

It’s the first pitch.

Let’s play ball.