The Future is Brightest at the Bottom

The Negative Crude Oil Price Moment for California Cannabis

A few months ago, we read quotes like this about the cannabis market in California:

“This is going to be the biggest extinction event of cannabis that we’ve seen, and it’s unavoidable,” Shaffer (owner of Shelby Ridge, a small farm in unincorporated Mendocino County) said.

In July not much has changed:

“There’s a lot of stress and despair out there. They’re struggling across the board. They’re losing their shirt,” said Kristin Nevedal, manager of the Mendocino County Cannabis Program.

Personally, I have heard plenty of stories of the pain and suffering in California. I’ve heard that some private nurseries are experiencing sales declines of 90% and I know that many farms are going fallow and giving up licenses. I’ve even heard that an MSO (multi-state operator) was begged to take over a cultivation operation as long as they assume the debt owed. As I wrote last week, equipment and service providers are seeing sales plunge, with the best example being Hydrofarm, which is down 86% this year alone.

But the biggest evidence of the “extinction event” was last Thursday’s startling filing from Innovative Properties (NYSE: IIPR), that one of their largest tenants, King’s Garden, a huge cultivator in California, which was forecasting $300 million in sales in 2023, defaulted on their lease payments.

The main culprit? The wholesale price of cannabis is below marginal cost of production due to too much short-term supply, too high taxes, and not enough dispensaries.

Despite this pain and suffering, I’m writing to tell you, it’s time to be bullish on California cannabis.

The first reason is that the California government is moving aggressively and quite quickly to address the problems of the past. California just eliminated their cultivation tax, which was a flat tax and represented the second highest cost for cultivators. The cultivation tax was annoying at a flat $160 per pound when prices were $800 to $1000 a pound. It is life threatening when prices are at $400 per pound.

The second reason to be optimistic is that markets are great at balancing supply and demand. There has been too much supply for the past year and a lot of that supply has been filled by small, sub-scale cultivators. It is estimated that 80% of the cannabis farms in California are sub-scale. These farms tend to be more expensive to run. As with any commodity activity, but especially with farming, size and scale matter. Farms are being shut down left and right and the pendulum has swung so hard, and pricing has fallen so far that even big cultivators like King’s Garden are being pulled under.

The third reason to be optimistic, is that California has unclogged the regulatory jam that was keeping the number of dispensaries too low. If California was like Colorado, it would have 4000+ dispensaries, not the measly 1000 it has now. However, things are now changing as California approved 8% of all dispensaries ever approved in the month of June alone! This is real progress.

And it’s not just new dispensaries that should make you bullish, but that many of these dispensaries are in cannabis deserts. Consider Fresno, a city with 500,000 people that has had no legal dispensaries. In the third quarter, four will open. The same goes for Oxnard, Costa Mesa and other cannabis deserts.

This makes for a perfect bullish storm: taxes are being cut, supply is aggressively leaving the market and demand should be increasing due to new dispensaries opening.

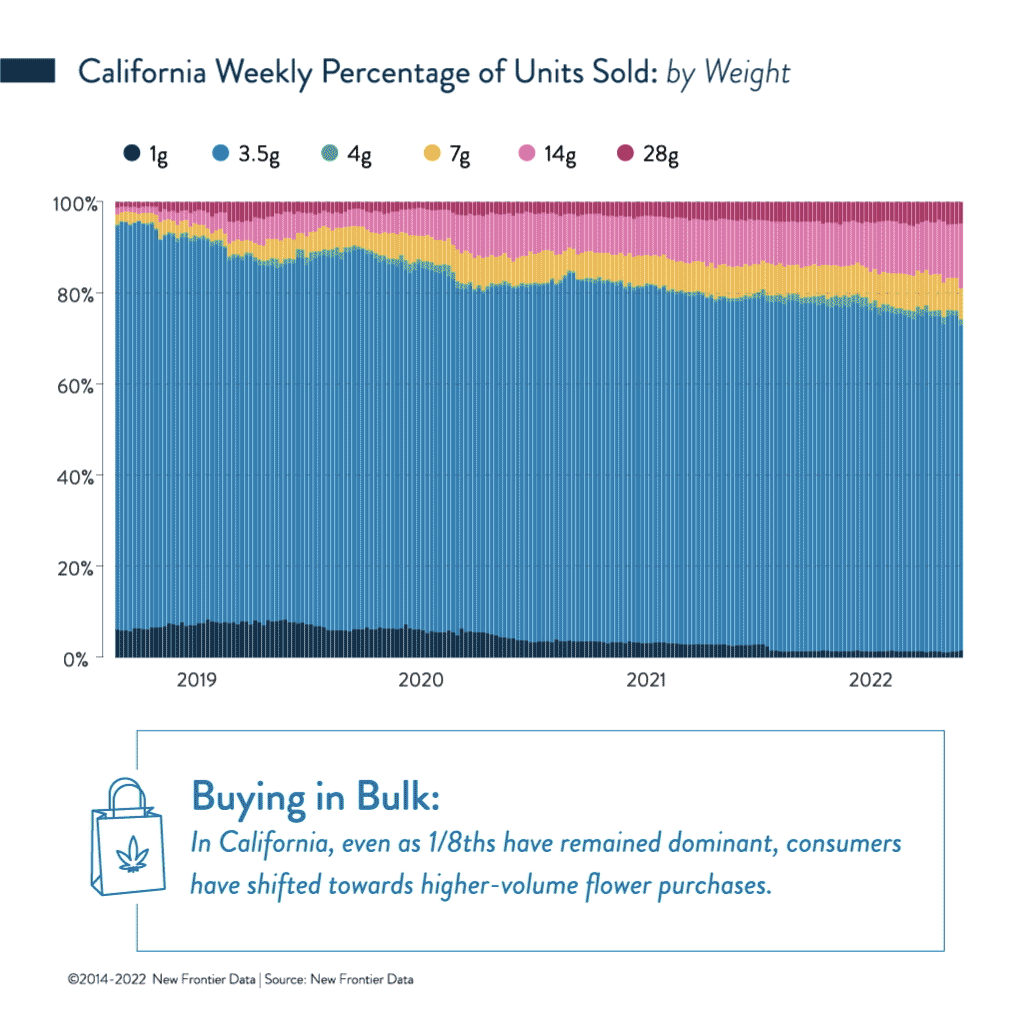

There is the also the very large illicit market. While price declines may be tough for producers, it is great news for consumers and makes the legal market more price competitive with the illicit market. And we have evidence of this already happening. The heavy consumers or “heavies” as Mitch Baruchowitz of Merida Capital calls them are starting to buy more from the legal market.

While we wait for California cannabis to return to a healthy market, there is an even more important reason to be bullish about California. The state remains, even with all its problems, the biggest cannabis market in the world. Not only is it the largest, but it has the most brands, the most competition and the most discerning customers. If you can make it here, you can make it anywhere.

Companies that are honing their products and offerings by competing with a thousand other brands must be the best. Cultivators that must compete at $400 a pound cannabis are developing a quality to cost structure that would destroy any limited license operator enjoying $3000 to $4000 a pound markets that rely on regulatory capture. One day, interstate barriers will come down, and who would you bet on to win?

If you have been following this newsletter, you know I’m bullish on the long-term future of Glass House (OTC: GLASF) and I think the company will see a real inflection as they turn on their state-of-the-art greenhouse in Ventura County. And outside of short-term pain, the future looks bright with less supply and more dispensary demand.

I’m also pleased to announce, that I just made my second investment in California, by leading the debt restructuring of a leading private California brand. I’m very excited to invest in this scrappy, innovative company as I think with a clean balance sheet, they can grow when others are retrenching.

Just like when crude oil went negative in the second quarter of 2020, the price of cannabis in California is below the cost of production for even the most efficient operators like Glass House. But with capital scarce, operators can only fund losses for so long before they must stop. And this is exactly when you want to get bullish.

My bet is that next year, the California cannabis market will look very different than it does now, with higher prices, fewer companies, and brands, which will lead to a much healthier market. I’m doubling down on California and I’m on the hunt for more investments. Remember that the oil market went from not being able to give away oil, to outcries from sticker shock from people filling up their tank in less than two years. California cannabis is experiencing its negative crude oil moment. We know how this story ends.