Why is Cresco Paying Such a High Price for Columbia Care?

Thoughts on the Proposed Merger

Sometimes the market is just smarter than you are.

Since the end of May, I have been baffled by how cannabis stocks with a presence in the state of Illinois have reacted to news that 185 new dispensaries are coming online. Those dispensaries had been locked up in a legal battle, which was finally resolved. For anyone with wholesale capacity and manufacturing, this is a $1 billion revenue opportunity. I wrote about it as well, calling it the Fundamental Disconnect.

One company that stood to benefit the most is Cresco Labs (OTC: CRLBF). But instead of rallying on the news, Cresco like the entire sector fell, though recently it has rallied as the whole sector has bounced. So, what was I missing that the market was smarter about?

I think the answer is Columbia Care (OTC: CCHWF).

Cresco is in the process of merging with Columbia Care, a large multi-state operator, and the transaction which was announced in March is supposed to close by year’s end. After reviewing Columbia Care’s second quarter and dramatically lower guidance for the balance of the year, I think investors are worried about the dilutive effects from Cresco buying Columbia Care. There may also be a worry that it might take a lot of heavy lifting to improve the Columbia Care’s operational performance.

Columbia Care missed some revenue estimates by almost 13% and EBITDA estimates by 50%. Forward guidance was slashed by almost 40%. Columbia Care trades at a remarkable 19 times EV to 2022 EBITDA estimates right now, but at the deal price, Columbia Care will be acquired at a valuation of more than 20 times 2022 EBITDA estimates.

Compare that to the average of Tier 1 cannabis companies trading at 11 times, or especially a Tier 1 operator like Verano (OTC: VRNOF) trading for 8 times consensus estimates for 2022.

Why is Cresco paying such a high multiple for Columbia Care, which is obviously fundamentally underperforming? I understand that Columbia Care is in an enviable position in Virginia, but beyond that what exactly are Cresco shareholders getting besides a highly levered underperforming MSO?

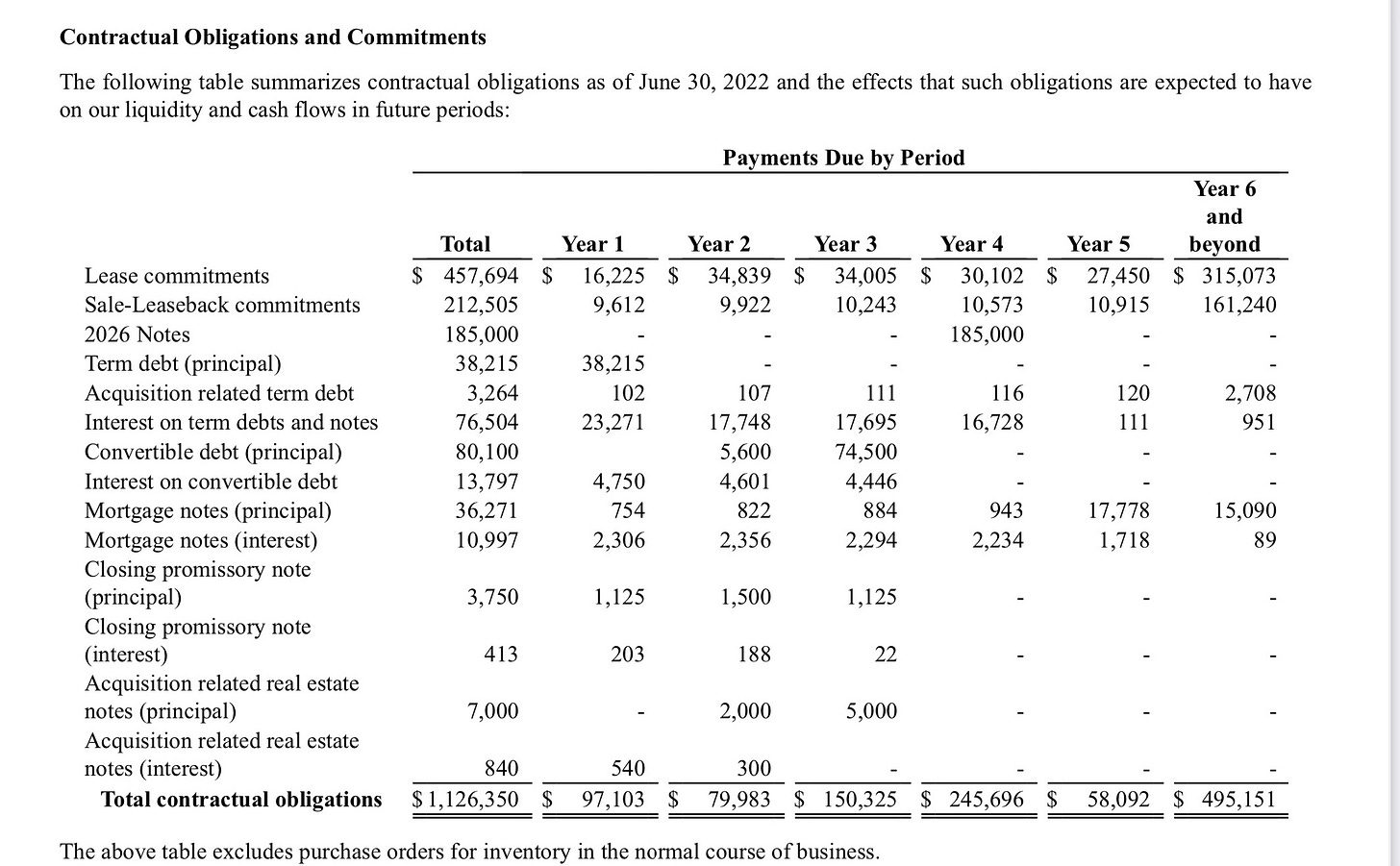

Check out the leverage that Columbia Care has on the books.

As part of the deal, the plan is that Columbia Care will divest certain assets and that will pay down debt, but with the state of the markets and cannabis in general, at what valuations will those divestitures happen?

Cannabis valuations have been crushed this year, the capital markets are closed, and many cannabis stocks are down between 70-90% from their highs.

You would imagine that in this environment a cannabis company that misses estimates by a mile and takes down annual guidance by almost 40% halfway through the year would be one of the worst performing stocks in the sector. But you would wrong precisely because of the merger agreement with Cresco.

Columbia Care, is only down 30% for the year, compared to 51% for the MSOS.

My concern that Cresco may proceed with this deal as planned is what caused me to use the latest rally to sell my position in Cresco. I’ve learned the hard way from AYR Wellness (OTC: AYRWF) that turnarounds can take a very long time. It has taken AYR almost two years to turn around Liberty Health, which it acquired in late 2020.

And with capital markets the way they are, who exactly will be bidding for the divestures that the deal requires and at what prices?

Compare Columbia Care’s valuation to Ascend (OTC: AAWH), AYR or MariMed (OTC: MRMD), all which have dramatically lower valuations. I’m not sure that valuation differential makes any sense.

I would love to be a shareholder again of Cresco, but for that to happen, we either need SAFE Banking or they need to re-price this merger agreement. Without SAFE Banking passing by year end, it could be dangerous for Cresco to effectively lever up their balance sheet and operations by proceeding with the merger as planned.

Things that would change my mind are positive divestiture news, positive movement from the state of Virginia (which has very favorable licensing for existing operators like Columbia Care) or SAFE Banking passing. For now, I’m on the sidelines watching and waiting to see what happens.