Watching a stock fall from $18 to $4 is a humbling experience. Even more humbling is having friends and family call and text, asking what they should do about the substantial losses they are sitting on.

I’m very bullish on cannabis as I’ve written before (Is Cannabis the New SaaS?). However, from 2019 to early 2020, while I was excited, I was simultaneously losing a ton of money on what is now AYR Wellness (Canada: AYR, OTC: AYRWF) when it was called Cannabis Strategies Acquisition Corporation and then AYR Strategies. The company was set up as a SPAC. Regulatory delays, lack of liquidity and a collapse in sentiment due to problems in the Canadian cannabis market helped send the stock plunging.

Good news for me is that one year later, AYR Wellness is now $34 per share and I think it is headed much higher on the back of soaring cash flow.

I mention this because operational and regulatory stumbles happen even for companies with strong management and great business models. It’s even worse for companies who are underperforming and whose management teams are not the right fit, or if the business model is challenged.

If operating a cannabis company was easy MedMen’s chart wouldn’t look like this:

And that’s why it pays to proceed cautiously even in the most exciting of areas. Cannabis may have years of growth ahead, but that doesn’t mean all companies are created equal.

I thought it might be helpful to look under the hood of two recent cannabis companies that have come public or are about to come public via SPAC (Special Purpose Acquisition Corporation) vehicles and highlight some concerns and questions. Please note that I have no position in either company.

The Parent Company (OTC: GRAMF)

Jay-Z is kind of the headline act here with a collection of assets in California. The general idea is they are building a California branded business that can be taken elsewhere in the country and will one day be very valuable once cannabis is de-regulated.

Here are some open questions I have regarding the company. Take a look at this slide from their presentation.

There seem to be a lot of cooks in the kitchen. How will all of these executives and managers operate together? It seems like a very expensive bench to keep.

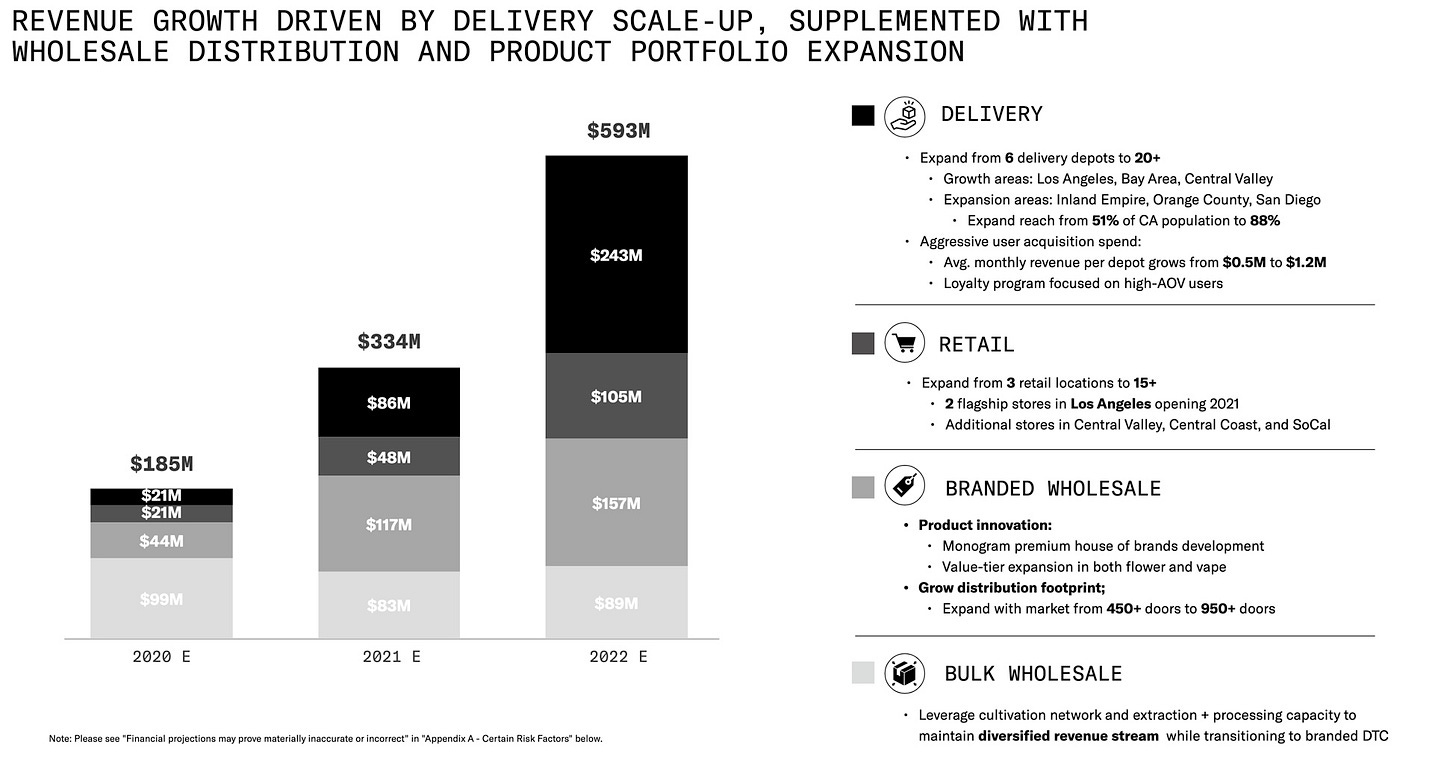

This is a more important chart. 54% of the company’s revenue in 2020 came from low-margin bulk wholesale. And the higher margin branded wholesale business is projected to grow 250%. But that is nothing on their expectation that their delivery business will grow incredible 10 times in two years!

And the financial projections show this story: the company is currently a low margin business that loses money but is supposed to make a ton of money in the future. They may be able to execute, but investors are taking on a lot of risk if the ramp is less than expected.

Finally, on slide 28, hidden in the footnotes, it looks like TPCO has many more shares outstanding than investors realize. I come up with 172 million shares without the warrants (which convert at $11.50), not the headline number of 116.7 million. 46 million shares were given to vendors, for what reason I have no idea. What happens when those vendors decide to cash out? And then over $11.50, we get further dilution with the warrants, meaning if the stock rises, the fully diluted count is 208 million, almost 100% higher than the company appears to have.

I’m staying on the sidelines of this one as I think they have a lot to prove.

Ceres Acquisition Corporation and its Planned Merger with Parallel

Another SPAC, Ceres Acquisition Corp (Canada: CERE, OTC: CERAF) announced that it was merging with Parallel, which is run by Beau Wrigley (who was formerly the CEO of Wrigley before its sale to Mars). Entertainment entrepreneur and executive Scooter Braun is joining as well. At first, I was excited by the news and the company appeared cheap, but there are questions and worries that popped up the more I dug in.

One thing that stuck out to me is that on Slide 19 of the company’s presentation, they highlight “Pending markets.” And later, the presentation mentions that they expect to win a license in New Jersey. To me this is very promotional, and I do not know why any company would highlight a market they are not in, nor are they under contract to acquire another company that exists in that market.

Then there is the management slide.

Why is there a Chief Information Officer but no Chief Operating Officer? I can tell you that I would feel a whole lot less confident in AYR Wellness if AYR’s COO, Jen Drake, was not involved. And also, while I can criticize TPCO for having too many cooks in the kitchen, Parallel might have too few. And how can I tell? The margins.

Slide 23 tells the story.

How are you selling cannabis in Massachusetts and Florida and yet you only are going to earn $18 million of “adjusted” EBITDA in 2020? In fact, this whole slide has worrisome data points on it. What exactly does “in-process high confidence new market” mean? And how can you say that there is upside from New Jersey when you don’t even operate, nor have a license there?

And finally, check out Slide 39

There is a “COVID adjustment” showing apparently what EBITDA would have been. I’m not sure what that means. And then there is the obligatory revenue and EBITDA ramp with no real explanation as to why or how.

For both TPCO and Ceres/Parallel there is too much uncertainty in how they will hit their aggressive targets. My experience with AYR tells me that if there is a stumble or two, these stocks could plunge to levels that take your breath away.

So, I keep plugging away, doing research and trying to find the next AYR Wellness and make sure I don’t lose my critical thinking when I’m bullish on cannabis. Or as Tony Montana once said, “Don’t get high on your own supply.”