Power Law Dynamics

Further Reflections from My Interview with Hayden Capital’s Fred Liu

“I did a study of our historical holdings. We had made twenty-nine investments up until that point. But if you look at the top six investments, they are what drove like over one hundred percent of our returns up until that point. So, the other twenty-three investments basically netted out to zero.” Fred Liu of Hayden Capital

“If I’ve made one mistake in the course of managing investments it was selling really good companies too soon. Because generally, if you’ve made good investments, they will last for a long time.” Lou Simpson, former chief investment officer of GEICO

One of the hardest things to do as a value investor is to buy a stock that is already up significantly. Haven’t you as an investor already missed the easy money? And what kind of value investor are you if you buy when a stock is already near its highs? Value investors don’t buy stocks near 52-week highs! They focus on the 52-week low list or a stock that has been flat forever.

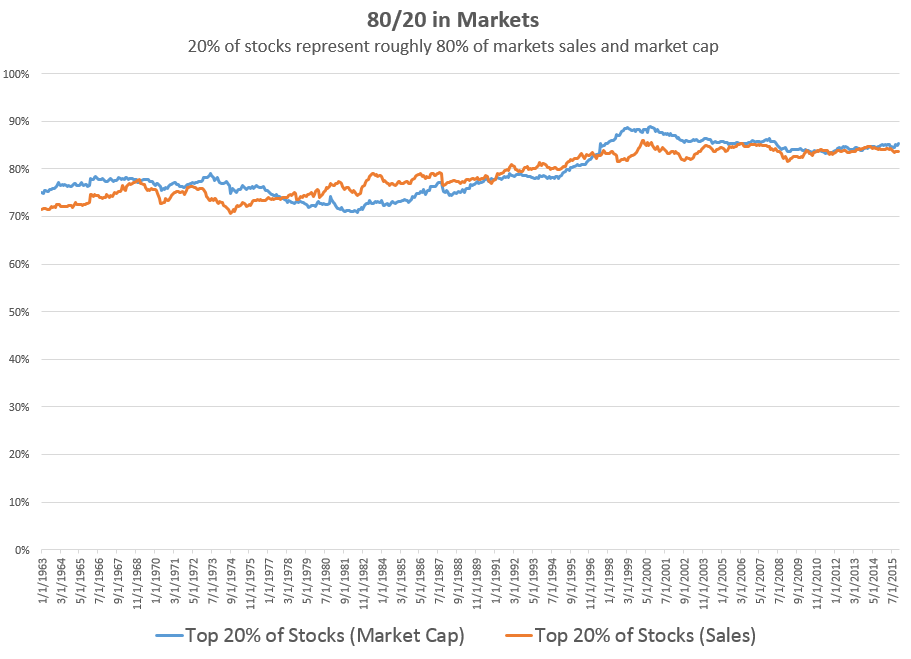

This old-line of value investing thinking misses out on a couple of important factors. Investments, like most things in life, tend to be distributed according to power law dynamics. 80% of your returns will most likely be from 20% or less of your investments. Consider how many stocks actually go up in value. In a study of stocks from 1926 to 2008, if you remove the top 25% best performing stocks, investment returns go from positive 9.6% annual returns to negative 0.6% per year.

And increasingly in an internet-enabled world, this trend may be narrowing the list of stocks driving all of the value as the winners end up dominating the market share and profits in their respective markets. Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Google (NASDAQ: GOOGL) and Facebook (NASDAQ: FB) are all examples of how the winners keep winning.

I’m reflecting on this after continuing to ponder my interview with Hayden Capital’s Fred Liu, who might just be up 200% this year after fees. In the interview, Fred discusses how he looks for signposts along the way that indicate a company will separate from the pack and that when that happens the company becomes less risky and more likely to potentially earn 80% of the industry’s profits over the next 10 to 15 years. And the implication is that even though the stock may be at a 52-week high or have doubled, it may be even less risky than it was before because the future outlook is so much clearer.

I’ve always thought of catalysts as ways to realize value, not necessarily to press my bets to take advantage of power law distributions. But in a world increasingly dominated by winner take all dynamics, this may be a way to positively increase returns without taking excess risks, not by just letting your winners run, but by actually buying more of your winners as they increase.

The stock market used to be more mean reverting, where stocks went up and down, industries went up and down, but things always returned to a competitive balance. At least for now, it appears that the Internet has upended this cozy relationship and definitely ruined the old way of investing based upon mean reversion. The Internet allows a scale and dominance that is breathtaking.

Consider Berkshire Hathaway (NYSE: BRK-B) and their investment in Snowflake (NASDAQ: SNOW). I wrote about how the investment decisions made by Buffett & company were perplexing including the way they invested in SNOW (Should Warren Buffett Dismantle Berkshire Hathaway).

Could Berkshire have seen something in the SNOW that led to their investment at absurdly high valuations at the IPO? Could they have seen how their subsidiaries are using the company’s products and realized that SNOW was going to capture 80% of this new sector’s profits for the next 10-15 years? My bet is yes. Otherwise, why would they do something that was so out of character?

This column is basically my rumination on power law dynamics and my interview with Fred. The lesson may be to re-focus my portfolio and all future investment ideas stressing the importance of leaning in when companies’ competitive dynamics shift gears. I want to make sure I’m taking advantage of power law distributions and make sure I stay committed to those investments that keep winning. Instead of looking to take some money “off the table,” maybe in this new world, it is time to start doubling down.

Here is the link to the transcript of my interview with Fred Liu:

http://www.mindsetcapital.com/wp-content/uploads/2020/12/Fred-Liu-Interview.pdf

P.S. I’m aware that some of this is a reflection of the spectacular bull market we are in, but power law dynamics have been in effect for a very long time in the stock market. I continue to believe this market eerily parallels 1999/2000 market and wrote about it here: 1999, the Sequel.

**The graph above is from Investors Field Guide.