Two Sells and a Hold

BioSpecifics, Disney and Nintendo

#Neversell is a hashtag that really started to appear in earnest on Twitter in August. When investors are bragging about never selling stocks, you know you are in a bull market. The frequency of the topic just happened to pop up right before the most recent sell off. Go figure.

But it actually brings up a good point that is worth exploring. When should you sell a stock? Instead of sharing a generic answer, I thought I would share three recent decisions I made regarding BioSpecifics (NASDAQ: BSTC), Disney (NYSE: DIS) and Nintendo (Tokyo: 7974, US: NTDOY).

Change at BioSpecifics Plus Delays Equals a Sell

In February of this year, I wrote up BioSpecifics. I thought it was a mis-priced growing royalty stream. Here is the deep-dive research report I wrote at the time: BioSpecifics Report.

BioSpecifics earns a royalty stream on a drug called Xiaflex, which treats two different diseases, Peyronie’s and Dupuytren’s contracture. The diagnosis rates of both diseases are very low and Xiaflex is the only approved medical treatment. It was also on the cusp of getting approval for another indication, treating cellulite on women’s bodies.

I ended up selling BioSpecifics and here is why. First, BioSpecifics’ patent ends in 2028, so timing is of the essence in terms of sales, earnings and cash flows. COVID ended up putting off patient visits, delaying marketing initiatives focused on growth, sales and revenue. It also put off the launch for the new indication on cellulite. Sales and earnings plummeted, and it may not be until 2022 that we see sales growth again. Losing 12-18 months out of an eight-year exclusivity window is a material event.

Adding to the reasons to sell was a new CEO who was subsequently fired. The company adopted a poison pill and then issued a bizarre filing that is an “at the money equity offering.” Why would a company have to raise money when it has $120 million in the bank? The company just collects royalties. This suggests the company wants to empire build.

The final problem is that BioSpecific’s marketing and sales partner is Endo Pharmaceuticals, which is having financial and litigation problems (opioid and mesh products). COVID may have weakened them to the point where they may need to enter Chapter 11, which would complicate sales, marketing and royalty payments if this were to happen.

In summary, I sold because risks have increased substantially, major decisions that didn’t make sense were made and the loss of 12 to 18 months of sales decreased the company’s value. Having said that, the company is still interesting, and I may re-visit it in the future, especially if the stock price weakens materially.

Disney’s COVID and Now Chinese Risk

I initially sold Disney in February on fears over what COVID would do to its theme park business.

My view on Disney was that their theme park business was not being properly valued and that negativity around Disney+ did not make sense. When COVID flared up, it obviously challenged my basic premise and in risk control I sold. I always wanted to re-purchase the stock until I started reflecting on its relationship with China, and this is what has given me pause. I do not know how to analyze the risk of Disney being caught in the middle of the growing economic conflict between America and China. Disney has two theme parks in China. And they also have done quite well with theatrical releases in China, which is one of the reasons they decided to re-make a live version of Mulan.

But now we read these stories in the Washington Post: Mulan Criticism.

And an oped like this: Disney Mulan Scandal.

And here is the problem, I cannot quantify Disney’s China risk. My reason for owning Disney was their theme parks, plus the optionality of Disney+. Anything that hurts the theme parks business hurts my reason for investing.

For an alternative take, consider that Dan Loeb with Third Point recently announced a big stake in Disney and thinks the company is undervalued (Third Point Disney article). I have enormous respect for Dan as an investor, I just worry that Disney is not Netflix, nor are they properly set up to succeed like Netflix. Disney’s strategy is to drive more consumers into the Disney ecosystem not to be a Netflix. Any transition to a Netflix model could be quite painful and turbulent for shareholders.

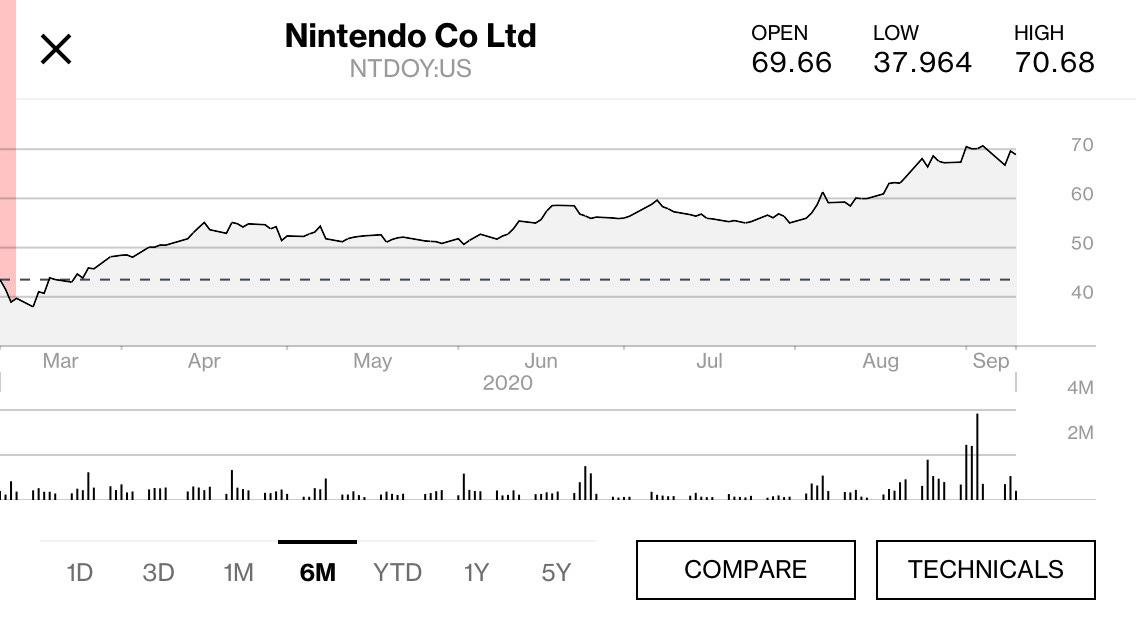

Nintendo Goes Up a Lot, Should I Sell?

The biggest mistake value investors like me can make is selling too early. When you are a value investor part of the appeal is that no one agrees with you. And then you hope that changes.

I have doubled my money in Nintendo since I invested in the company 18 months ago. My basic thesis (Nintendo Is 2013 Microsoft), is that Nintendo is on the cusp of a major transformation that investors have not appreciated or valued properly. In fact, Nintendo has outperformed my expectations and its outlook is now much brighter than when I first bought the stock.

COVID has proven to be an accelerant to gaming and has increased the addressable market and Nintendo has been perfectly positioned to take advantage of this. Their Switch console continues to be sold out and demand for their games continues to soar. But more importantly, the company’s transition from physical game sales to digital has accelerated. This has driven a margin explosion as digital sales have margins that are 3000 basis points higher than physical.

I believe that the Switch platform has a high likelihood of developing into an iPhone-like gaming platform, in which people keep all of their games and data and upgrade their Switch every three years or so. And that despite strong sales to date, the Switch’s potential is much greater than investors expect.

Consider that the Gameboy launched in the late 1980s sold almost 120 million units. Nintendo’s DS launched in 2004 sold 154 million units. I would argue the video game market is much, much bigger now. The Switch has sold 62 million to date. I think the Switch family of devices has a credible shot of getting to 200 million-unit sales. If I’m right, we are still early in the Switch cycle and definitely not near the peak of the cycle.

So, the only thing that has changed for Nintendo is that while the stock price is higher, the outlook is even better than when I first invested. And despite its run, thanks to its explosive earnings growth, the stock still sells for a measly 16 times this year’s estimated earnings excluding its cash and holdings in Niantic and The Pokemon Company. Incredibly, despite doubling, the stock is still cheap!

Summary

In summary, I try to sell when my thesis changes or something material increases the risk of holding the stock. In the case of BioSpecifics and Disney, my risk analysis changed, and I sold. With Nintendo, things are actually better. There is probably even an argument for buying more if it wasn’t such a big position in my portfolio.

As always, I recognize that I could be very wrong, but I find that reviewing my decisions and writing down my thoughts help me clarify my perspectives on my positions. My hope is that by sharing my thoughts and decision-making process, it helps you decide when you may need to sell or choose to hold in the future.