Women Are No Longer Happi with Just Wine

What Survey Data of Women Tells Us About the Future of Wine Consumption

The losses keep stacking up for the U.S. wine industry.

Wine sales in the U.S. last year tumbled approximately 6% from 2023, according to data from the industry data group SipSource. The drop is the latest in a long-term decline in wine demand in restaurants, bars and stores that some are calling an “existential threat” to the industry.

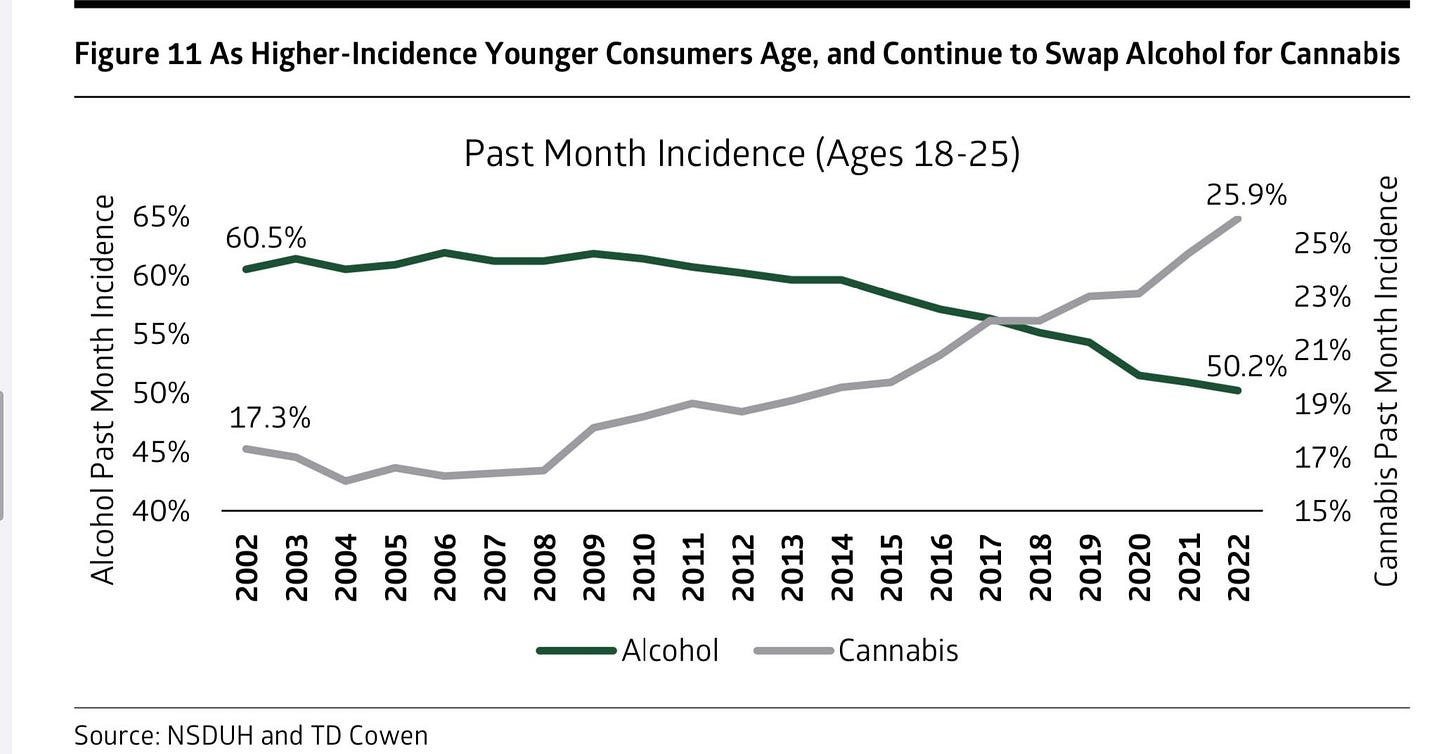

The wine industry is in a world of hurt right now. Last March, I started writing about how alcohol consumption was falling, and I cited this chart:

I also wrote about how farmers were starting to rip out vineyards.

Across California, farmers are ripping out their vineyards en masse. This uprooting is the result of a yearslong oversupply: With wine consumption in the U.S. declining, wineries are decreasing production, which means they need fewer grapes.

And I’m writing this update to warn that it’s going to get worse. And we can blame women for the dire outlook for the $100 billion wine industry.

Women used to drink a lot less than men. However, over the last few decades, a combination of savvy wine marketing and changing social norms (think “Mommy Juice”) led to women drinking about the same rate as men and has also led to women now making up approximately 60% of wine sales.

Lots of women use alcohol to unwind and relax. The problem for the alcohol industry is that cannabis is simply a vastly better alternative for relaxation than alcohol. I’ve previously called cannabis the great replacement.

Last week, I wrote about zebra striping, which is when people alternate between alcohol and non-alcoholic beverages like cannabis drinks and how this can lead to big market share losses. And these kind of losses is exactly what we are starting to see show up in alcohol companies’ earnings reports.

But it is the survey data I recently received from one of my portfolio companies, Happi, that details the seismic changes happening in real time. Happi is a female led, female focused brand. Lisa Hurwitz and her co-founder Joe Reynolds have built an impressive brand that has leaned into women, especially women over the age of 35.

Happi has a database of 80,000 customers and their surveys show in detail how cannabis beverages are taking market share from wine and alcohol companies. Approximately 80% of Happi’s customers are women. Their data shows that 40% of their customers not only drink Happi but also consume alcohol multiple times a week. And based on Happi’s data, 75% of those frequent alcohol drinkers are primarily wine drinkers.

The most fascinating piece of their surveys shows that their female consumers swap alcohol for Happi beverages during the week, when after a long day, they want to relax but then switch back to alcohol during the weekend when they want to socialize and party.

This may not sound like much, but it could have profound implications for the wine industry.

Let’s assume that the wine industry is a $100 billion market and that 60% of consumers are women. That means women spend $60 billion a year on wine. Now let’s assume that the average female consumer replaces her glass of wine three days a week with a Happi beverage or another cannabis beverage. If this female normally consumes 6 glasses of wine a week, that is 50% replacement, if she consumes 9 drinks, it is 33% replacement. Let’s be uber conservative and assume that it is just 20% replacement.

That may mean that the consumption patterns may change by 12%, or $12 billion. Just by focusing on women that wants to unwind at the end of the day, Happi is attacking a niche that could be worth $12 billion in annual revenue!

And this is what is so exciting about low-dose hemp beverages, the alcohol industry is enormous at $250 billion in annual revenue. The different occasions that people drink vary quite a bit and people use alcohol for different reasons. Just a seemingly small niche like the working woman who wants to unwind or the mom who wants to chill at the end of the day can be worth tens of billions of dollars.

And seeing this happen in real time and with consumer survey data, not only makes me very excited for the future, but it makes me very, very Happi.