As a professional money manager, why do I feel so alone in researching, investing and writing about US cannabis stocks? Sure, there are others writing about cannabis such as Todd Harrison with CB1 Capital or Mitch Baruchowitz with Merida Capital, but their job is to solely invest in cannabis. Me? I’m a generalist. As I’ve shared publicly, I am an investor in Nintendo (Japan: 7974), Nelnet (NYSE: NNI) and Mexican stocks such as Consorcio Ara (Mexico: ARA) and Bolsa Mexicana (Mexico: BOLSAA). But I also have a significant percentage of my portfolio in a select few cannabis stocks such as AYR Wellness (Canada: AYR, OTC: AYRWF).

And it is bewildering why other investors are not clamoring to invest in the cannabis space considering the following:

1. Many companies are growing at 50-100% rates, yet trade at modest cash flow multiples. AYR for example trades at 7-8 times my estimate of next year’s cash flow.

2. There are significant regulatory barriers on the state and local level that allow for outsized margins. I’ve written about how some companies are seeing 70%+ gross margins and 40% EBITDA margins.

3. The size of the market is massive already. Estimates are that the market is $100 billion, much of which is currently illegal. But now because of choice, safety, quality and access, the legal market is eating the illegal market and growing faster.

So, what is going on? Why is it crickets out here?

I think the answer lies in seeing what happens when a state goes from allowing medical cannabis to full adult use. Sales of cannabis explodes higher by two to three times when adult use is allowed. Getting a medical card for cannabis in a state that allows medicinal use is not hard, nor is it hard to get a prescription. So, why do sales jump when you remove the simple barrier of getting a medical card?

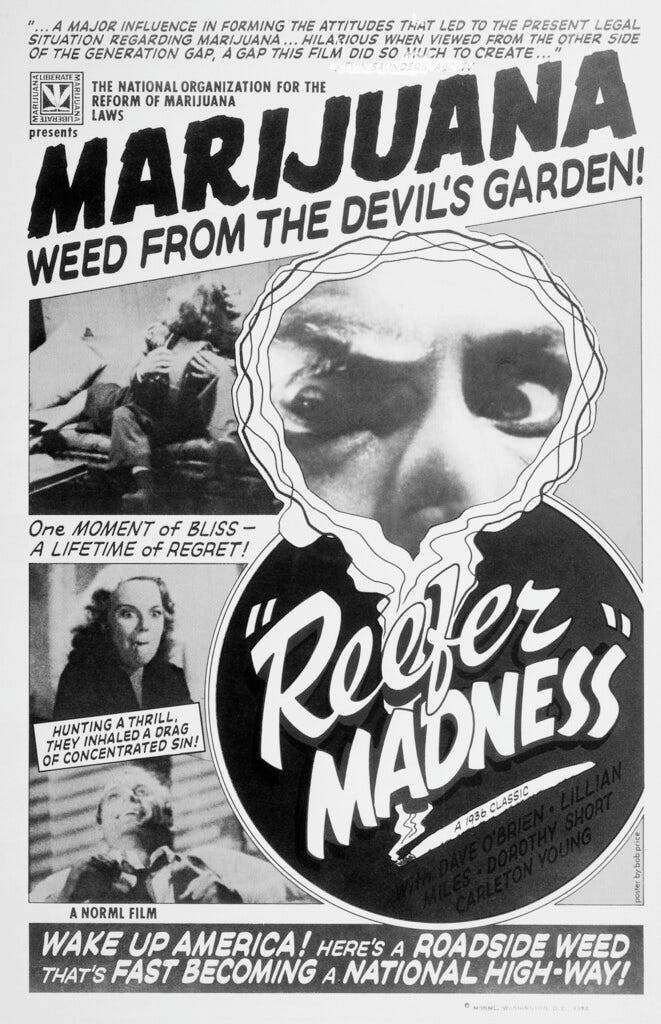

I believe that most people want to follow with the law. Cannabis is still illegal on a Federal level and carries a stigma that is decades in the making based on industrial corruption, misperceptions, racist overtones and outright lies. Once a state fully legalizes cannabis, I believe that the stigma of using it plummets. That is why sales jump so much.

And I believe that a major reason that generalist money managers are not investing in cannabis is that it “feels wrong.” Investors who are happy to invest in tobacco, alcohol or even weapons manufacturers are not yet willing to invest in cannabis. Of course, there are clearly money managers who are uncomfortable investing in a space where the legality is murky, but I believe most money managers do not want to be seen doing anything that doesn’t “feels right.” Even though cannabis is now legal for either medicinal use, adult use or fully decriminalized in 44 out of the 50 US states, the Federal government still views it as illegal.

My own personal experience proves this out when I found myself having an internal debate on whether to write publicly about cannabis. And I’ve talked to a few other money managers who are dabbling in the space but are not ready to talk publicly about cannabis.

Outside of the stigma, there is the bigger issue of compliance and risk as a big driver of the lack of investment. Many investors are simply not allowed by their compliance departments to invest. Just this week, I talked to one portfolio manager who works at a firm with over $75 billion in assets. The compliance department believes that investing in cannabis puts the firm at risk for violating money laundering laws, so none of the firm’s capital can invest in the space. But this money manager and a few of the other portfolio manager are investing in cannabis personally and cannot believe the values that they are finding.

And it’s not just the compliance department of investment firms, but also prime brokerages that are stopping investors from investing in cannabis. Anyone who uses Pershing as either a prime broker or a clearing house cannot buy any US cannabis stocks that touch the flower. Investors using Robinhood cannot buy any US cannabis stocks either.

Here is the good news though, as Mitch Baruchowitz told me, cannabis is being normalized faster than it is being legalized. Ellen Degeneres was just on national TV talking about drinking a cannabis beverage, New York is now going fully legal, Alabama and Tennessee are working on medical cannabis legislation. There are bipartisan sponsored Congressional bills about allowing banks to deal with cannabis companies and congressional committees are working on removing some of the punitive taxes that cannabis companies pay.

What is so fascinating is while sales are soaring and normalization is happening on a consumer and even congressional level, not much has changed yet at the professional investor level. That will change and so will valuations. I think this will be the decade of cannabis and that investors have an opportunity to earn outsized returns before capital pours into the industry. Cannabis stocks may be volatile due to lower than normal liquidity, but longer term those shares are headed in one direction: higher.